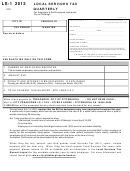

NOTICE OF CHANGE IN BUSINESS

NEW OWNERS - DO NOT USE PREVIOUS OWNER'S RETURN

If there has been a change in your business since the preceding return, please furnish applicable information below and mail to Miscellaneous Tax, Kansas

Department of Revenue, 915 SW Harrison St., Topeka, Kansas 66612-1588.

Name as shown on return:

Taxpayer ID No.

New person to contact:

Phone No. (

)

New business name:

New business address:

Mailing address:

Business being discontinued as of:

Business being sold as of:

Name and mailing address of new owner(s):

INSTRUCTIONS FOR COMPLETING TRANSIENT GUEST TAX RETURN

The transient guest tax is levied upon the gross receipts derived from or paid by transient guests for sleeping accommodations in any

hotel, motel or tourist court. The tax does not apply where a room is rented by an individual for a period of more than twenty-eight

(28) consecutive days, or where the federal government pays directly for the room (these are the only exceptions). If the guest pays for

the room and is later reimbursed by the federal government, the transient guest tax would still apply.

The tax must be collected by the hotel, motel or tourist court from the consumer or user and remitted to the Kansas Department of

Revenue. Records of gross receipts must be kept separate and apart from the records of other retail sales made by the business. The

transient guest tax charge must be stated separately on the invoice to the guest and not be combined with the charge for sales tax.

Line 1 Enter amount of gross receipts on line 1 received from charges for sleeping accommodations.

Line 2 Enter amount included in gross receipts which represents receipts received from renting of a room by a person for a period

exceeding twenty-eight (28) consecutive days and direct rentals to the federal government.

Line 3 Amount subject to tax. Subtract line 2 from line 1.

Line 4 Multiply the amount shown on line 3 by the appropriate tax rate shown on line 4.

Line 5 Enter the amount of penalty due for delinquent payment of Transient Guest Tax. A penalty of 10% of the amount shown

on line 4 is due when the tax is paid after the due date. If the tax is paid more than sixty (60) days after the original due

date, a 25% penalty is due. Additional information regarding penalty rates can be obtained at our web site:

Line 6 Enter the amount of interest due for delinquent payment of Transient Guest Tax (both penalty and interest are due if the

tax is paid after the due date). Information regarding current year or prior year interest rates can be obtained at our web

site:

Line 7 Enter the amount of tax, penalty and interest due (Add lines 4, 5 and 6).

Line 8 Enter the amount of a verified credit memorandum issued by the Kansas Department of Revenue. The credit

memorandum(s) must be enclosed with the return. Note: A debit memorandum must be paid by a separate check and

returned to the Kansas Department of Revenue.

Line 9 Enter total amount of tax, penalty and interest remitted with this return.

If you have questions concerning transient guest tax or completing your return, direct them to:

Miscellaneous Tax / Customer Relations

Phone: 785-368-8222

Kansas Department of Revenue

Fax: 785-291-3968

915 SW Harrison St.

Miscellaneous.Tax@kdor.ks.gov

Topeka, Kansas 66612-1588

1

1 2

2