General Filing Instructions For Nonprofit Articles Of Incorporation Form - Arizona Corporation Commission

ADVERTISEMENT

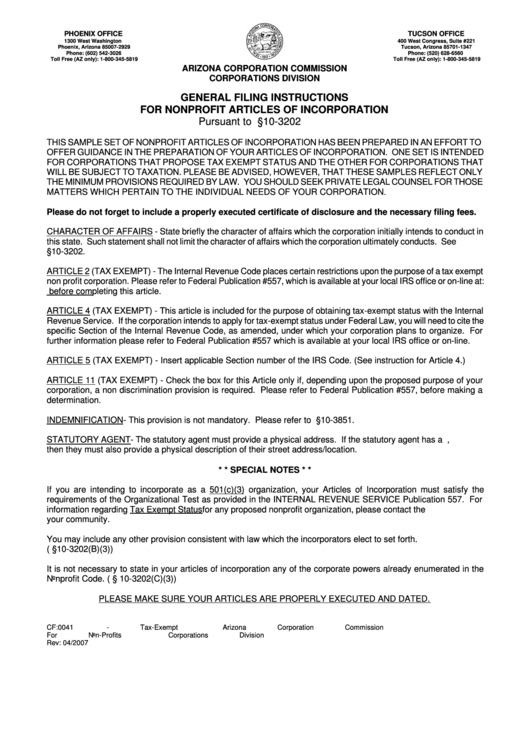

PHOENIX OFFICE

TUCSON OFFICE

1300 West Washington

400 West Congress, Suite #221

Phoenix, Arizona 85007-2929

Tucson, Arizona 85701-1347

Phone: (602) 542-3026

Phone: (520) 628-6560

Toll Free (AZ only): 1-800-345-5819

Toll Free (AZ only): 1-800-345-5819

ARIZONA CORPORATION COMMISSION

CORPORATIONS DIVISION

GENERAL FILING INSTRUCTIONS

FOR NONPROFIT ARTICLES OF INCORPORATION

Pursuant to A.R.S. §10-3202

THIS SAMPLE SET OF NONPROFIT ARTICLES OF INCORPORATION HAS BEEN PREPARED IN AN EFFORT TO

OFFER GUIDANCE IN THE PREPARATION OF YOUR ARTICLES OF INCORPORATION. ONE SET IS INTENDED

FOR CORPORATIONS THAT PROPOSE TAX EXEMPT STATUS AND THE OTHER FOR CORPORATIONS THAT

WILL BE SUBJECT TO TAXATION. PLEASE BE ADVISED, HOWEVER, THAT THESE SAMPLES REFLECT ONLY

THE MINIMUM PROVISIONS REQUIRED BY LAW. YOU SHOULD SEEK PRIVATE LEGAL COUNSEL FOR THOSE

MATTERS WHICH PERTAIN TO THE INDIVIDUAL NEEDS OF YOUR CORPORATION.

Please do not forget to include a properly executed certificate of disclosure and the necessary filing fees.

CHARACTER OF AFFAIRS - State briefly the character of affairs which the corporation initially intends to conduct in

this state. Such statement shall not limit the character of affairs which the corporation ultimately conducts. See A.R.S.

§10-3202.

ARTICLE 2 (TAX EXEMPT) - The Internal Revenue Code places certain restrictions upon the purpose of a tax exempt

non profit corporation. Please refer to Federal Publication #557, which is available at your local IRS office or on-line at:

before completing this article.

ARTICLE 4 (TAX EXEMPT) - This article is included for the purpose of obtaining tax-exempt status with the Internal

Revenue Service. If the corporation intends to apply for tax-exempt status under Federal Law, you will need to cite the

specific Section of the Internal Revenue Code, as amended, under which your corporation plans to organize. For

further information please refer to Federal Publication #557 which is available at your local IRS office or on-line.

ARTICLE 5 (TAX EXEMPT) - Insert applicable Section number of the IRS Code. (See instruction for Article 4.)

ARTICLE 11 (TAX EXEMPT) - Check the box for this Article only if, depending upon the proposed purpose of your

corporation, a non discrimination provision is required. Please refer to Federal Publication #557, before making a

determination.

INDEMNIFICATION - This provision is not mandatory. Please refer to A.R.S. §10-3851.

STATUTORY AGENT - The statutory agent must provide a physical address. If the statutory agent has a P.O. Box,

then they must also provide a physical description of their street address/location.

* * SPECIAL NOTES * *

If you are intending to incorporate as a 501(c)(3) organization, your Articles of Incorporation must satisfy the

requirements of the Organizational Test as provided in the INTERNAL REVENUE SERVICE Publication 557. For

information regarding Tax Exempt Status for any proposed nonprofit organization, please contact the I.R.S. office in

your community.

You may include any other provision consistent with law which the incorporators elect to set forth.

(A.R.S. §10-3202(B)(3))

It is not necessary to state in your articles of incorporation any of the corporate powers already enumerated in the

Nonprofit Code. (A.R.S. § 10-3202(C)(3))

PLEASE MAKE SURE YOUR ARTICLES ARE PROPERLY EXECUTED AND DATED.

CF:0041 - Tax-Exempt

Arizona Corporation Commission

For Non-Profits

Corporations Division

Rev: 04/2007

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2