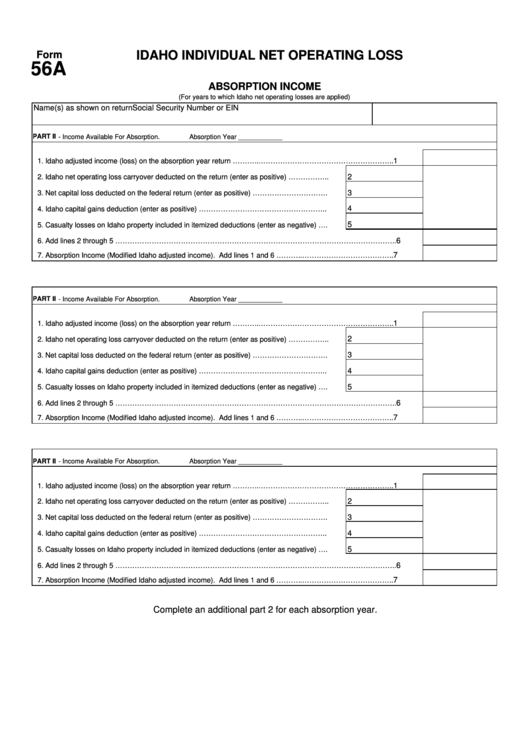

Form 56a - Idaho Individual Net Operating Loss - Absorption Income

ADVERTISEMENT

IDAHO INDIVIDUAL NET OPERATING LOSS

Form

56A

ABSORPTION INCOME

(For years to which Idaho net operating losses are applied)

Name(s) as shown on return

Social Security Number or EIN

PART II - Income Available For Absorption.

Absorption Year ____________

1

1. Idaho adjusted income (loss) on the absorption year return ………..………………………………………………..

2

2. Idaho net operating loss carryover deducted on the return (enter as positive) ……………..

3

3. Net capital loss deducted on the federal return (enter as positive) ………………………….

4

4. Idaho capital gains deduction (enter as positive) ……………………………………………..

5

5. Casualty losses on Idaho property included in itemized deductions (enter as negative) ….

6

6. Add lines 2 through 5 ……………………………………………………………………………………………………..

7

7. Absorption Income (Modified Idaho adjusted income). Add lines 1 and 6 ………..………………………………..

PART II - Income Available For Absorption.

Absorption Year ____________

1

1. Idaho adjusted income (loss) on the absorption year return ………..………………………………………………..

2

2. Idaho net operating loss carryover deducted on the return (enter as positive) ……………..

3

3. Net capital loss deducted on the federal return (enter as positive) ………………………….

4

4. Idaho capital gains deduction (enter as positive) ……………………………………………..

5

5. Casualty losses on Idaho property included in itemized deductions (enter as negative) ….

6

6. Add lines 2 through 5 ……………………………………………………………………………………………………..

7

7. Absorption Income (Modified Idaho adjusted income). Add lines 1 and 6 ………..………………………………..

PART II - Income Available For Absorption.

Absorption Year ____________

1

1. Idaho adjusted income (loss) on the absorption year return ………..………………………………………………..

2

2. Idaho net operating loss carryover deducted on the return (enter as positive) ……………..

3

3. Net capital loss deducted on the federal return (enter as positive) ………………………….

4

4. Idaho capital gains deduction (enter as positive) ……………………………………………..

5

5. Casualty losses on Idaho property included in itemized deductions (enter as negative) ….

6

6. Add lines 2 through 5 ……………………………………………………………………………………………………..

7

7. Absorption Income (Modified Idaho adjusted income). Add lines 1 and 6 ………..………………………………..

Complete an additional part 2 for each absorption year.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1