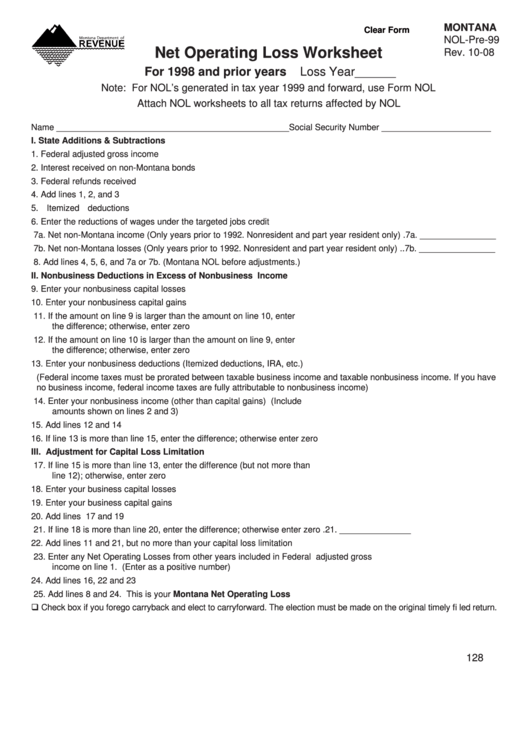

MONTANA

Clear Form

NOL-Pre-99

Net Operating Loss Worksheet

Rev. 10-08

For 1998 and prior years

Loss Year______

Note: For NOL’s generated in tax year 1999 and forward, use Form NOL

Attach NOL worksheets to all tax returns affected by NOL

Name _________________________________________________ Social Security Number _______________________

I. State Additions & Subtractions

1. Federal adjusted gross income .................................................................... 1. _______________

2. Interest received on non-Montana bonds .................................................... 2. _______________

3. Federal refunds received ............................................................................. 3. _______________

4. Add lines 1, 2, and 3 .....................................................................................................................4. ________________

5. Itemized deductions ......................................................................................................................5. ________________

6. Enter the reductions of wages under the targeted jobs credit ......................................................6. ________________

7a. Net non-Montana income (Only years prior to 1992. Nonresident and part year resident only) .7a. ________________

7b. Net non-Montana losses (Only years prior to 1992. Nonresident and part year resident only) ..7b. ________________

8. Add lines 4, 5, 6, and 7a or 7b. (Montana NOL before adjustments.) ...........................................8. ________________

II. Nonbusiness Deductions in Excess of Nonbusiness Income

9. Enter your nonbusiness capital losses .........................................................................................9. ________________

10. Enter your nonbusiness capital gains .........................................................................................10. ________________

11. If the amount on line 9 is larger than the amount on line 10, enter

the difference; otherwise, enter zero ...........................................................................................11. ________________

12. If the amount on line 10 is larger than the amount on line 9, enter

the difference; otherwise, enter zero ...........................................................................................12. ________________

13. Enter your nonbusiness deductions (Itemized deductions, IRA, etc.) ........................................13. ________________

(Federal income taxes must be prorated between taxable business income and taxable nonbusiness income. If you have

no business income, federal income taxes are fully attributable to nonbusiness income)

14. Enter your nonbusiness income (other than capital gains) (Include

amounts shown on lines 2 and 3) .............................................................. 14. _______________

15. Add lines 12 and 14 ................................................................................... 15. _______________

16. If line 13 is more than line 15, enter the difference; otherwise enter zero ..................................16. ________________

III. Adjustment for Capital Loss Limitation

17. If line 15 is more than line 13, enter the difference (but not more than

line 12); otherwise, enter zero ................................................................... 17. _______________

18. Enter your business capital losses ............................................................ 18. _______________

19. Enter your business capital gains .............................................................. 19. _______________

20. Add lines 17 and 19 .................................................................................. 20. _______________

21. If line 18 is more than line 20, enter the difference; otherwise enter zero . 21. _______________

22. Add lines 11 and 21, but no more than your capital loss limitation .............................................22. ________________

23. Enter any Net Operating Losses from other years included in Federal adjusted gross

income on line 1. (Enter as a positive number) .........................................................................23. ________________

24. Add lines 16, 22 and 23 ..............................................................................................................24. ________________

25. Add lines 8 and 24. This is your Montana Net Operating Loss ..............................................25. ________________

Check box if you forego carryback and elect to carryforward. The election must be made on the original timely fi led return.

128

1

1 2

2 3

3