Form K-67 - Kansas Application For Carryback Of Net Operating Farm Loss Refund -

ADVERTISEMENT

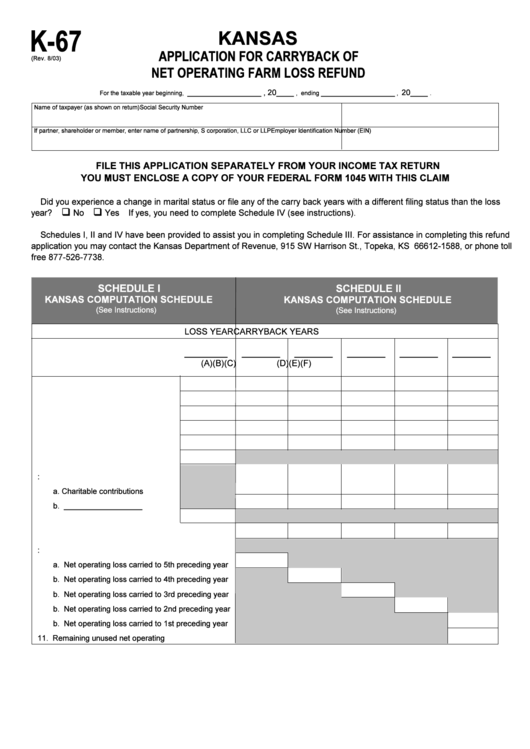

K-67

KANSAS

APPLICATION FOR CARRYBACK OF

(Rev. 8/03)

NET OPERATING FARM LOSS REFUND

_________________ , 20____

_________________

20____

For the taxable year beginning,

, ending

,

.

Name of taxpayer (as shown on return)

Social Security Number

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP

Employer Identification Number (EIN)

FILE THIS APPLICATION SEPARATELY FROM YOUR INCOME TAX RETURN

YOU MUST ENCLOSE A COPY OF YOUR FEDERAL FORM 1045 WITH THIS CLAIM

Did you experience a change in marital status or file any of the carry back years with a different filing status than the loss

q

q

year?

No

Yes

If yes, you need to complete Schedule IV (see instructions).

Schedules I, II and IV have been provided to assist you in completing Schedule III. For assistance in completing this refund

application you may contact the Kansas Department of Revenue, 915 SW Harrison St., Topeka, KS 66612-1588, or phone toll

free 877-526-7738.

SCHEDULE I

SCHEDULE II

KANSAS COMPUTATION SCHEDULE

KANSAS COMPUTATION SCHEDULE

(See Instructions)

(See Instructions)

LOSS YEAR

CARRYBACK YEARS

_________

________

________

________

________

________

(A)

(B)

(C)

(D)

(E)

(F)

1. Taxable income per Kansas return ..

2. Net operating loss from prior year ...

3. Net capital loss .................................

4. Nontaxable capital gain ....................

5. Exemptions ......................................

6. Excess nonbusiness deductions ......

7. Other adjustments:

a. Charitable contributions ...............

b. __________________ ................

8. Net operating loss ............................

9. Modified taxable income ...........................................

10. Net operating loss carryback:

a. Net operating loss carried to 5th preceding year

b. Net operating loss carried to 4th preceding year

b. Net operating loss carried to 3rd preceding year

b. Net operating loss carried to 2nd preceding year

b. Net operating loss carried to 1st preceding year

11. Remaining unused net operating loss .......................

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3