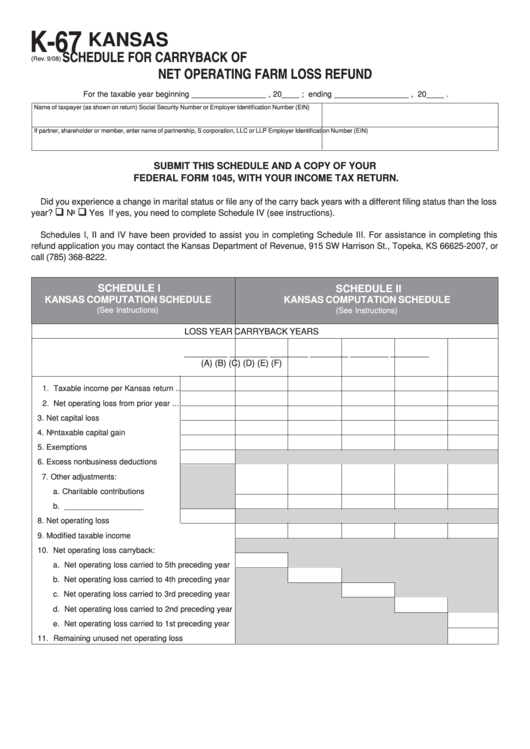

K-67

KANSAS

SCHEDULE FOR CARRYBACK OF

(Rev. 9/08)

NET OPERATING FARM LOSS REFUND

For the taxable year beginning _________________ , 20____ ; ending _________________ , 20____ .

Name of taxpayer (as shown on return)

Social Security Number or Employer Identification Number (EIN)

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP

Employer Identification Number (EIN)

SUBMIT THIS SCHEDULE AND A COPY OF YOUR

FEDERAL FORM 1045, WITH YOUR INCOME TAX RETURN.

Did you experience a change in marital status or file any of the carry back years with a different filing status than the loss

‰

‰

year?

No

Yes If yes, you need to complete Schedule IV (see instructions).

Schedules I, II and IV have been provided to assist you in completing Schedule III. For assistance in completing this

refund application you may contact the Kansas Department of Revenue, 915 SW Harrison St., Topeka, KS 66625-2007, or

call (785) 368-8222.

SCHEDULE I

SCHEDULE II

KANSAS COMPUTATION SCHEDULE

KANSAS COMPUTATION SCHEDULE

(See Instructions)

(See Instructions)

LOSS YEAR

CARRYBACK YEARS

_________

________

________

________

________

________

(A)

(B)

(C)

(D)

(E)

(F)

1. Taxable income per Kansas return ..

2. Net operating loss from prior year ...

3. Net capital loss .................................

4. Nontaxable capital gain ....................

5. Exemptions ......................................

6. Excess nonbusiness deductions ......

7. Other adjustments:

a. Charitable contributions ...............

b. __________________ ................

8. Net operating loss ............................

9. Modified taxable income ...........................................

10. Net operating loss carryback:

a. Net operating loss carried to 5th preceding year

b. Net operating loss carried to 4th preceding year

c. Net operating loss carried to 3rd preceding year

d. Net operating loss carried to 2nd preceding year

e. Net operating loss carried to 1st preceding year

11. Remaining unused net operating loss .......................

1

1 2

2 3

3 4

4