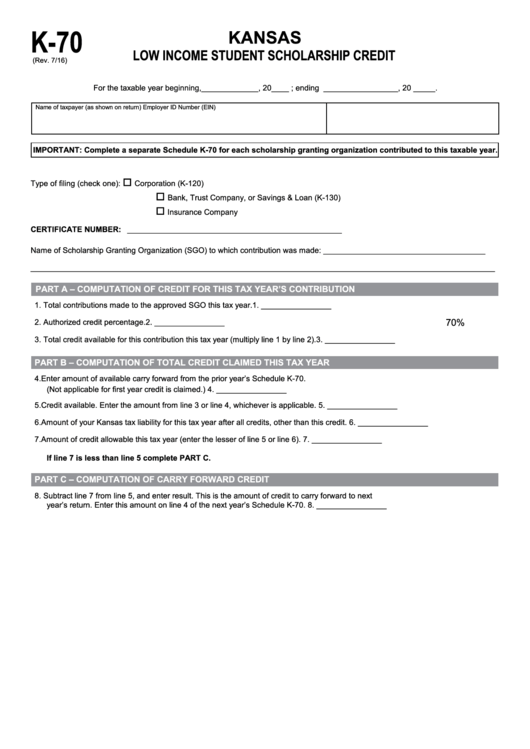

K-70

KANSAS

LOW INCOME STUDENT SCHOLARSHIP CREDIT

(Rev. 7/16)

For the taxable year beginning, _____________ , 20 ____ ; ending _________________ , 20 _____.

Name of taxpayer (as shown on return)

Employer ID Number (EIN)

IMPORTANT: Complete a separate Schedule K-70 for each scholarship granting organization contributed to this taxable year.

o

Type of filing (check one):

Corporation (K-120)

o

Bank, Trust Company, or Savings & Loan (K-130)

o

Insurance Company

CERTIFICATE NUMBER:

_________________________________________________

Name of Scholarship Granting Organization (SGO) to which contribution was made:

_____________________________________

__________________________________________________________________________________________________________

PART A – COMPUTATION OF CREDIT FOR THIS TAX YEAR’S CONTRIBUTION

1. Total contributions made to the approved SGO this tax year.

1.

________________

70%

2. Authorized credit percentage.

2.

________________

3. Total credit available for this contribution this tax year (multiply line 1 by line 2).

3.

________________

PART B – COMPUTATION OF TOTAL CREDIT CLAIMED THIS TAX YEAR

4. Enter amount of available carry forward from the prior year’s Schedule K-70.

(Not applicable for first year credit is claimed.)

4.

________________

5. Credit available. Enter the amount from line 3 or line 4, whichever is applicable.

5.

________________

6. Amount of your Kansas tax liability for this tax year after all credits, other than this credit.

6.

________________

7. Amount of credit allowable this tax year (enter the lesser of line 5 or line 6).

7.

________________

If line 7 is less than line 5 complete PART C.

PART C – COMPUTATION OF CARRY FORWARD CREDIT

8. Subtract line 7 from line 5, and enter result. This is the amount of credit to carry forward to next

year’s return. Enter this amount on line 4 of the next year’s Schedule K-70.

8.

________________

1

1