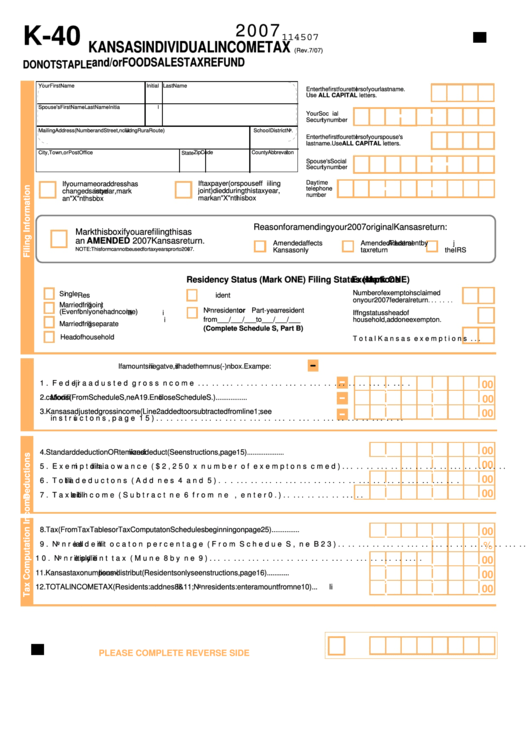

Form K-40 - Kansas Individual Income Tax And/or Food Sales Tax Refund - 2007

ADVERTISEMENT

2007

K-40

114507

KANSAS INDIVIDUAL INCOME TAX

(Rev. 7/07)

and/or FOOD SALES TAX REFUND

DO NOT STAPLE

Your First Name

Initia

l

Last Name

Enter the first four etters of your last name.

l

Use

ALL CAPITAL letters.

- -

Spouse's First Name

Initia

l

Last Name

Your Soc

ial

Secur ty number

i

Mailing Address (Number and Street, nclud ng Rura Route)

i

i

l

School District No.

Enter the first four etters of your spouse's

l

last name. Use ALL CAPITAL letters.

-

-

City, Town, or Post Office

Zip Code

County Abbrev at

i ion

State

Spouse's Social

Secur ty number

i

- -

Daytime

If taxpayer (or spouse f f

i iling

If your name or address has

tel

ephone

joi

nt) died during this tax year,

changed s

ince l

ast year, mark

number

mark an "X" n this box

i

an "X" n th s box

i

i

Reason for amending your 2007 original Kansas return:

Mark this box if you are filing this as

an

AMENDED 2007 Kansas return.

Amended affects

Amended Federal

Ad ustment by

j

NOTE: This form cannot be used for tax years pr or to 2007.

i

Kansas only

tax return

the IRS

Filing Status (Mark ONE)

Residency Status (Mark ONE)

Exemptions

Number of exempt ons claimed

i

Si

ngle

Res

ident

on your 2007 federal return

. . . . . . .

Married f ng oint

ili

j

Nonresident or

Part-year resident

(Even f only one had ncome)

i

i

If f ng status s head of

ili

i

from ___/___/___ to ___/___/___

household, add one exempt on . . . . . . .

i

Married f ng separate

ili

(Complete Schedule S, Part B)

Head of household

Total Kansas exemptions . . . . . . .

-

If amount s negat ve, shade the m nus (-) n box.

i

i

i

i

Examp e:

l

-

,

,

.

1. Federa ad usted gross ncome . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

l

j

i

00

-

,

,

.

2.

Modifi

cations (From Schedule S, ne A19. Enclose Schedule S.). . . . . . . . . . . . . . . . .

li

00

,

,

.

-

3. Kansas adjusted gross income (Line 2 added to or subtracted from line 1; see

00

i

nstruct ons, page 15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

i

,

,

.

00

4. Standard deduction OR temized deduct

i

ions

(See nstructions, page 15). . . . . . . . . . . . . . . . . . . .

i

,

.

00

5. Exempt on a owance ($2,250 x number of exempt ons c med) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

i

ll

i

lai

,

,

.

00

6. Tota deduct ons (Add nes 4 and 5). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

l

i

li

,

,

.

00

7. Taxab

le i

ncome (Subtract ne 6 from ne 3. If less than zero, enter 0.) . . . . . . . . . . . . . . . . .

li

li

,

,

.

8. Tax (From Tax Tables or Tax Computat on Schedules beginning on page 25) . . . . . . . . . . . . . . .

i

00

9. Nonres dent

i

all

ocat on percentage (From Schedu e S, ne B23). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

i

l

li

%

,

,

.

10. Nonres dent tax (Mu

i

ltiply li

ne 8 by ne 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

li

00

,

,

.

11. Kansas tax on ump sum distribut

l

ions

(Residents only see nstructions, page 16). . . . . . . . . . . .

-

i

00

,

,

.

12. TOTAL INCOME TAX (Residents: add nes 8 & 11; Nonresidents: enter amount from ne 10). . .

li

li

00

PLEASE COMPLETE REVERSE SIDE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2