Form Nyc-9.6 - Claim For Credit Applied To General Corporation Taxes - 2015

ADVERTISEMENT

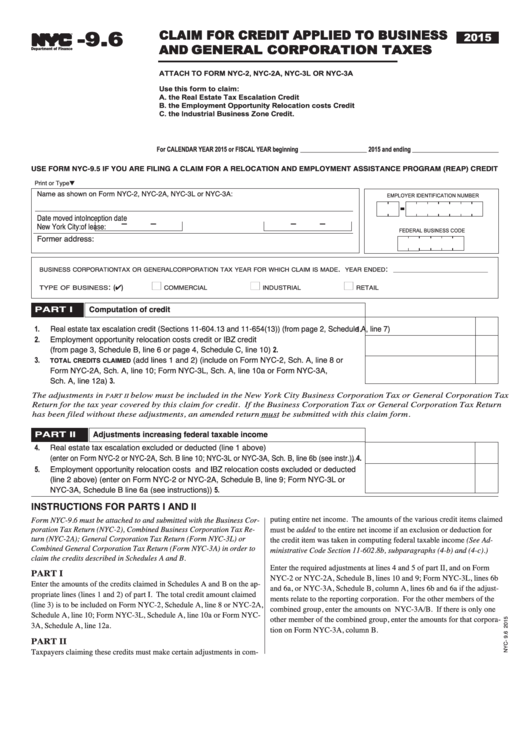

- 9.6

CLAIM FOR CREDIT APPLIED TO BUSINESS

2015

AND GENERAL CORPORATION TAXES

TM

Department of Finance

ATTACH TO FORM NYC-2, NYC-2A, NYC-3L OR NYC-3A

Use this form to claim:

A. the Real Estate Tax Escalation Credit

B. the Employment Opportunity Relocation costs Credit

C. the Industrial Business Zone Credit.

For CALENDAR YEAR 2015 or FISCAL YEAR beginning ____________________ 2015 and ending __________________________

use form Nyc-9.5 If you are fIlINg a claIm for a relocatIoN aNd employmeNt assIstaNce program (reap) credIt

Print or Type t

Name as shown on Form NYC-2, NYC-2A, NYC-3L or NYC-3A:

EMPLOYER IDENTIFICATION NUMBER

Date moved into

-

-

Inception date

-

-

New York City:

of lease:

FEDERAL BUSINESS CODE

Former address:

.

:

BUSINESS CORPORATION TAX OR GENERAL CORPORATION TAX YEAR FOR WHICH CLAIM IS MADE

YEAR ENDED

___________________________

n

n

n

:

(4)

TYPE OF BUSINESS

COMMERCIAL

INDUSTRIAL

RETAIL

part I

computation of credit

Real estate tax escalation credit (Sections 11-604.13 and 11-654(13)) (from page 2, Schedule A, line 7)

1.

1.

.

2.

Employment opportunity relocation costs credit or IBZ credit

(from page 3, Schedule B, line 6 or page 4, Schedule C, line 10)

2.

......................................................

3.

(add lines 1 and 2) (include on Form NYC-2, Sch. A, line 8 or

total credIts claImed

Form NYC-2A, Sch. A, line 10; Form NYC-3L, Sch. A, line 10a or Form NYC-3A,

Sch. A, line 12a)

3.

........................................................................................................................................................................

The adjustments in

below must be included in the New York City Business Corporation Tax or General Corporation Tax

PART II

Return for the tax year covered by this claim for credit. If the Business Corporation Tax or General Corporation Tax Return

has been filed without these adjustments, an amended return must be submitted with this claim form.

part II

adjustments increasing federal taxable income

4.

Real estate tax escalation excluded or deducted (line 1 above)

(enter on Form NYC-2 or NYC-2A, Sch. B line 10; NYC-3L or NYC-3A, Sch. B, line 6b (see instr.))

4.

...

5.

Employment opportunity relocation costs and IBZ relocation costs excluded or deducted

(line 2 above) (enter on Form NYC-2 or NYC-2A, Schedule B, line 9; Form NYC-3L or

NYC-3A, Schedule B line 6a (see instructions))

5.

.........................................................................................................

INstructIoNs for parts I aNd II

puting entire net income. The amounts of the various credit items claimed

Form NYC-9.6 must be attached to and submitted with the Business Cor-

must be added to the entire net income if an exclusion or deduction for

poration Tax Return (NYC-2), Combined Business Corporation Tax Re-

turn (NYC-2A); General Corporation Tax Return (Form NYC-3L) or

the credit item was taken in computing federal taxable income (See Ad-

Combined General Corporation Tax Return (Form NYC-3A) in order to

ministrative Code Section 11-602.8b, subparagraphs (4-b) and (4-c).)

claim the credits described in Schedules A and B.

Enter the required adjustments at lines 4 and 5 of part II, and on Form

PART I

NYC-2 or NYC-2A, Schedule B, lines 10 and 9; Form NYC-3L, lines 6b

Enter the amounts of the credits claimed in Schedules A and B on the ap-

and 6a, or NYC-3A, Schedule B, column A, lines 6b and 6a if the adjust-

propriate lines (lines 1 and 2) of part I. The total credit amount claimed

ments relate to the reporting corporation. For the other members of the

(line 3) is to be included on Form NYC-2, Schedule A, line 8 or NYC-2A,

combined group, enter the amounts on NYC-3A/B. If there is only one

Schedule A, line 10; Form NYC-3L, Schedule A, line 10a or Form NYC-

other member of the combined group, enter the amounts for that corpora-

3A, Schedule A, line 12a.

tion on Form NYC-3A, column B.

PART II

Taxpayers claiming these credits must make certain adjustments in com-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4