Schedule K-34 - Business And Job Development Credit Form - Kansas

ADVERTISEMENT

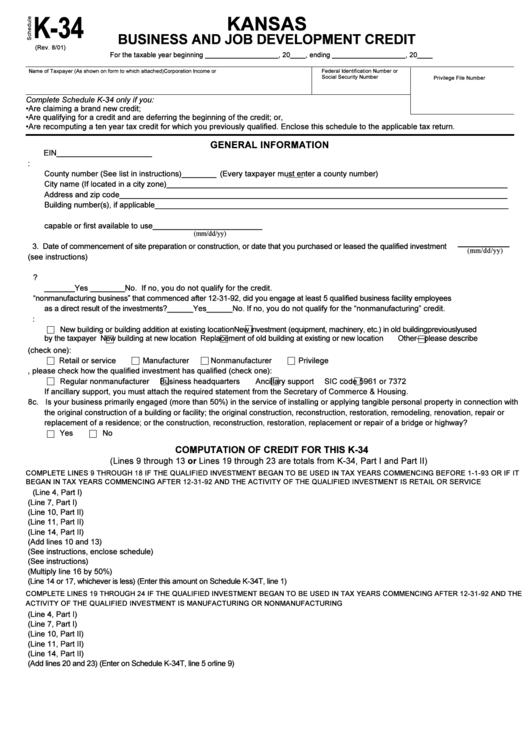

K-34

KANSAS

BUSINESS AND JOB DEVELOPMENT CREDIT

For the taxable year beginning ___________________, 20____, ending ___________________, 20____

Name of Taxpayer (As shown on form to which attached)

Federal Identification Number or

Corporation Income or

Social Security Number

Privilege File Number

Complete Schedule K-34 only if you:

• Are claiming a brand new credit;

• Are qualifying for a credit and are deferring the beginning of the credit; or,

• Are recomputing a ten year tax credit for which you previously qualified. Enclose this schedule to the applicable tax return.

GENERAL INFORMATION

1a. Name of legal entity making investment

____________________________________________

EIN ______________________

1b. Please enter the location of your qualified investment:

County number (See list in instructions) ________ (Every taxpayer must enter a county number)

City name (If located in a city zone) ______________________________________________________________________________

Address and zip code _________________________________________________________________________________________

Building number(s), if applicable _________________________________________________________________________________

2. Date commercial operations commenced for the qualified investment. This is the date that your qualified investment wasfirst

capable or first available to use _________________________

(mm/dd/yy)

3. Date of commencement of site preparation or construction, or date that you purchased or leased the qualified investment

(mm/dd/yy)

4a. Enter the Industry Group Number for the qualified investment (see instructions)

4b. Describe the business activity at the qualified business facility ________________________________________________________

5. Did you engage at least 2 qualified business facility employees as a direct result of the investments?

_______ Yes ________ No. If no, you do not qualify for the credit.

6. If you are a “nonmanufacturing business” that commenced after 12-31-92, did you engage at least 5 qualified business facility employees

as a direct result of the investments? ______ Yes ______ No. If no, you do not qualify for the “nonmanufacturing” credit.

7. Please check the space that best describes the type of qualified investment made at this facility:

New building or building addition at existing location

New investment (equipment, machinery, etc.) in old buildingpreviouslyused

by the taxpayer

New building at new location

Replacement of old building at existing or new location

Other—please describe

8a. Please check the type of qualified investment (check one):

Retail or service

Manufacturer

Nonmanufacturer

Privilege

8b. If a nonmanufacturer, please check how the qualified investment has qualified (check one):

Regular nonmanufacturer

Business headquarters

Ancillary support

SIC code 5961 or 7372

If ancillary support, you must attach the required statement from the Secretary of Commerce & Housing.

8c. Is your business primarily engaged (more than 50%) in the service of installing or applying tangible personal property in connection with

the original construction of a building or facility; the original construction, reconstruction, restoration, remodeling, renovation, repair or

replacement of a residence; or the construction, reconstruction, restoration, replacement or repair of a bridge or highway?

Yes

No

COMPUTATION OF CREDIT FOR THIS K-34

(Lines 9 through 13 or Lines 19 through 23 are totals from K-34, Part I and Part II)

COMPLETE LINES 9 THROUGH 18 IF THE QUALIFIED INVESTMENT BEGAN TO BE USED IN TAX YEARS COMMENCING BEFORE 1-1-93 OR IF IT

BEGAN IN TAX YEARS COMMENCING AFTER 12-31-92 AND THE ACTIVITY OF THE QUALIFIED INVESTMENT IS RETAIL OR SERVICE

9. Number of qualified business facility employees (Line 4, Part I) ................................................................................. ________________

10. Qualified business facility employee credit (Line 7, Part I) .......................................................................................... ________________

11. Qualified business facility investment (Line 10, Part II) .............................................................................................. ________________

12. Qualified business facility credit factor (Line 11, Part II) ............................................................................................. ________________

13. Qualified business facility investment credit (Line 14, Part II) ..................................................................................... ________________

14. Total (Add lines 10 and 13) .......................................................................................................................................... ________________

15. Qualified business facility income (See instructions, enclose schedule) .................................................................... ________________

16. Tax on qualified business facility income (See instructions) ....................................................................................... ________________

17. Business and job credit limitation (Multiply line 16 by 50%) ........................................................................................ ________________

18. Business and job development credit (Line 14 or 17, whichever is less) (Enter this amount on Schedule K-34T, line 1) ........ ________________

COMPLETE LINES 19 THROUGH 24 IF THE QUALIFIED INVESTMENT BEGAN TO BE USED IN TAX YEARS COMMENCING AFTER 12-31-92 AND THE

ACTIVITY OF THE QUALIFIED INVESTMENT IS MANUFACTURING OR NONMANUFACTURING

19. Number of qualified business facility employees (Line 4, Part I) ................................................................................. ________________

20. Qualified business facility employee credit (Line 7, Part I) .......................................................................................... ________________

21. Qualified business facility investment (Line 10, Part II) .............................................................................................. ________________

22. Qualified business facility credit factor (Line 11, Part II) ............................................................................................. ________________

23. Qualified business facility investment credit (Line 14, Part II) ..................................................................................... ________________

24. Total business and job development credit available (Add lines 20 and 23) (Enter on Schedule K-34T, line 5 or line 9) ......... ________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2