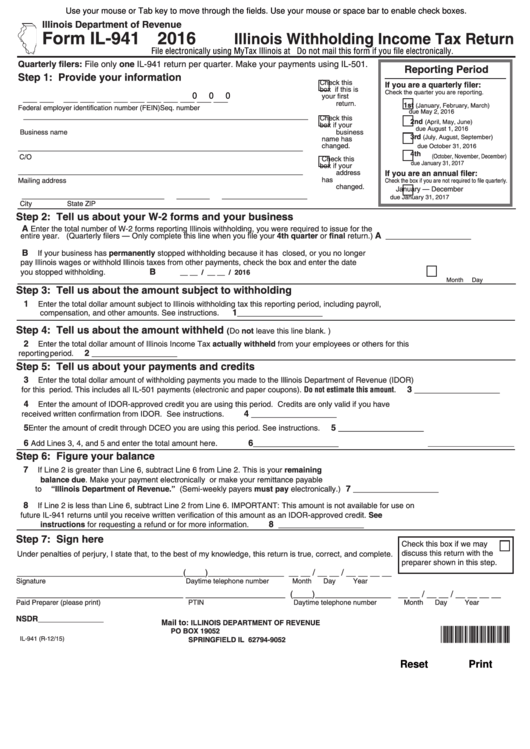

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

Form IL-941

2016

Illinois Withholding Income Tax Return

File electronically using MyTax Illinois at tax.illinois.gov. Do not mail this form if you file electronically.

Quarterly filers: File only one IL-941 return per quarter. Make your payments using IL-501.

Reporting Period

Step 1: Provide your information

Check this

If you are a quarterly filer:

box if this is

Check the quarter you are reporting.

0

0

0

your first

___ ___

___ ___ ___ ___ ___ ___ ___

___ ___ ___

return.

1st

(January, February, March)

Federal employer identification number (FEIN)

Seq. number

due May 2, 2016

Check this

2nd

____________________________________________________________

(April, May, June)

box if your

due August 1, 2016

Business name

business

3rd

name has

(July, August, September)

changed.

____________________________________________________________

due October 31, 2016

4th

(October, November, December)

C/O

Check this

due January 31, 2017

box if your

____________________________________________________________

If you are an annual filer:

address

has

Mailing address

Check the box if you are not required to file quarterly.

changed.

January — December

______________________________

_______

__________________

due January 31, 2017

City

State

ZIP

Step 2: Tell us about your W-2 forms and your business

A

Enter the total number of W-2 forms reporting Illinois withholding, you were required to issue for the

A __________________

entire year. (Quarterly filers — Only complete this line when you file your 4th quarter or final return.)

B

If your business has permanently stopped withholding because it has closed, or you no longer

pay Illinois wages or withhold Illinois taxes from other payments, check the box and enter the date

B

you stopped withholding.

__ __ / __ __ / 2016

Month

Day

Step 3: Tell us about the amount subject to withholding

1

Enter the total dollar amount subject to Illinois withholding tax this reporting period, including payroll,

1 __________________

compensation, and other amounts. See instructions.

Step 4: Tell us about the amount withheld

(Do not leave this line blank. )

2

Enter the total dollar amount of Illinois Income Tax actually withheld from your employees or others for this

2 __________________

reporting period.

Step 5: Tell us about your payments and credits

3

Enter the total dollar amount of withholding payments you made to the Illinois Department of Revenue (IDOR)

3 __________________

for this period. This includes all IL-501 payments (electronic and paper coupons). Do not estimate this amount.

4

Enter the amount of IDOR-approved credit you are using this period. Credits are only valid if you have

4 __________________

received written confirmation from IDOR. See instructions.

5

5 __________________

Enter the amount of credit through DCEO you are using this period. See instructions.

6

6 __________________

Add Lines 3, 4, and 5 and enter the total amount here.

Step 6: Figure your balance

7

If Line 2 is greater than Line 6, subtract Line 6 from Line 2. This is your remaining

balance due. Make your payment electronically or make your remittance payable

7 __________________

to “Illinois Department of Revenue.” (Semi-weekly payers must pay electronically.)

8

If Line 2 is less than Line 6, subtract Line 2 from Line 6. IMPORTANT: This amount is not available for use on

future IL-941 returns until you receive written verification of this amount as an IDOR-approved credit. See

8 __________________

instructions for requesting a refund or for more information.

Step 7: Sign here

Check this box if we may

discuss this return with the

Under penalties of perjury, I state that, to the best of my knowledge, this return is true, correct, and complete.

preparer shown in this step.

___________________________________(____)________________ __ __ / __ __ / __ __ __ __

Signature

Daytime telephone number

Month

Day

Year

___________________________________ _____________________ (____)________________ __ __ / __ __ / __ __ __ __

Paid Preparer (please print)

PTIN

Daytime telephone number

Month

Day

Year

NS

DR_______________

ILLINOIS DEPARTMENT OF REVENUE

Mail to:

PO BOX 19052

*IL-941*

SPRINGFIELD IL 62794-9052

IL-941 (R-12/15)

Reset

Print

1

1