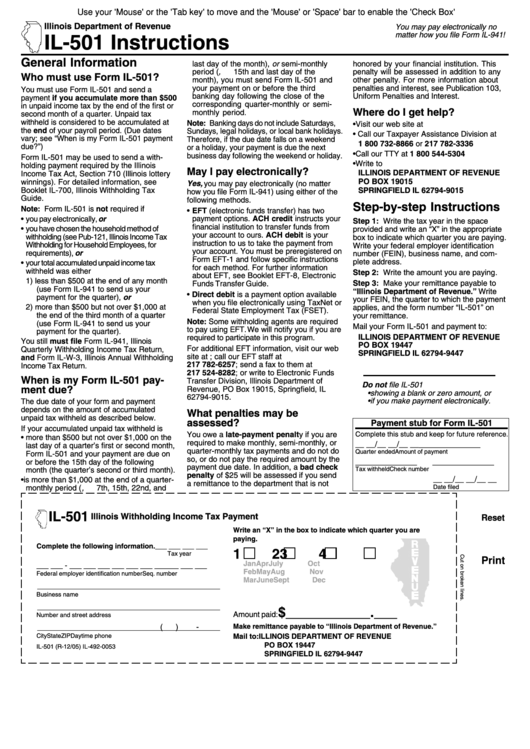

Use your 'Mouse' or the 'Tab key' to move and the 'Mouse' or 'Space' bar to enable the 'Check Box'

Illinois Department of Revenue

You may pay electronically no

matter how you file Form IL-941!

IL-501 Instructions

General Information

last day of the month), or semi-monthly

honored by your financial institution. This

period ( i.e., 15th and last day of the

penalty will be assessed in addition to any

Who must use Form IL-501?

month), you must send Form IL-501 and

other penalty. For more information about

your payment on or before the third

penalties and interest, see Publication 103,

You must use Form IL-501 and send a

banking day following the close of the

Uniform Penalties and Interest.

payment if you accumulate more than $500

corresponding quarter-monthly or semi-

in unpaid income tax by the end of the first or

Where do I get help?

monthly period.

second month of a quarter. Unpaid tax

withheld is considered to be accumulated at

Note: Banking days do not include Saturdays,

• Visit our web site at tax.illinois.gov

the end of your payroll period. (Due dates

Sundays, legal holidays, or local bank holidays.

• Call our Taxpayer Assistance Division at

vary; see “When is my Form IL-501 payment

Therefore, if the due date falls on a weekend

1 800 732-8866 or 217 782-3336

due?”)

or a holiday, your payment is due the next

• Call our TTY at 1 800 544-5304

business day following the weekend or holiday.

Form IL-501 may be used to send a with-

• Write to

holding payment required by the Illinois

May I pay electronically?

ILLINOIS DEPARTMENT OF REVENUE

Income Tax Act, Section 710 (Illinois lottery

PO BOX 19015

winnings). For detailed information, see

Yes, you may pay electronically (no matter

Booklet IL-700, Illinois Withholding Tax

SPRINGFIELD IL 62794-9015

how you file Form IL-941) using either of the

Guide.

following methods.

Step-by-step Instructions

Note: Form IL-501 is not required if

• EFT (electronic funds transfer) has two

• you pay electronically, or

payment options. ACH credit instructs your

Step 1: Write the tax year in the space

financial institution to transfer funds from

• you have chosen the household method of

provided and write an “X” in the appropriate

your account to ours. ACH debit is your

withholding (see Pub-121, Illinois Income Tax

box to indicate which quarter you are paying.

instruction to us to take the payment from

Withholding for Household Employees, for

Write your federal employer identification

your account. You must be preregistered on

requirements), or

number (FEIN), business name, and com-

Form EFT-1 and follow specific instructions

plete address.

• your total accumulated unpaid income tax

for each method. For further information

withheld was either

Step 2: Write the amount you are paying.

about EFT, see Booklet EFT-8, Electronic

1) less than $500 at the end of any month

Step 3: Make your remittance payable to

Funds Transfer Guide.

(use Form IL-941 to send us your

“Illinois Department of Revenue.” Write

• Direct debit is a payment option available

payment for the quarter), or

your FEIN, the quarter to which the payment

when you file electronically using TaxNet or

2) more than $500 but not over $1,000 at

applies, and the form number “IL-501” on

Federal State Employment Tax (FSET).

the end of the third month of a quarter

your remittance.

Note: Some withholding agents are required

(use Form IL-941 to send us your

Mail your Form IL-501 and payment to:

to pay using EFT. We will notify you if you are

payment for the quarter).

ILLINOIS DEPARTMENT OF REVENUE

required to participate in this program.

You still must file Form IL-941, Illinois

PO BOX 19447

For additional EFT information, visit our web

Quarterly Withholding Income Tax Return,

SPRINGFIELD IL 62794-9447

site at tax.illinois.gov; call our EFT staff at

and Form IL-W-3, Illinois Annual Withholding

217 782-6257; send a fax to them at

Income Tax Return.

217 524-8282; or write to Electronic Funds

When is my Form IL-501 pay-

Transfer Division, Illinois Department of

Do not file IL-501

ment due?

Revenue, PO Box 19015, Springfield, IL

• showing a blank or zero amount, or

62794-9015.

• if you make payment electronically.

The due date of your form and payment

depends on the amount of accumulated

What penalties may be

unpaid tax withheld as described below.

assessed?

Payment stub for Form IL-501

If your accumulated unpaid tax withheld is

You owe a late-payment penalty if you are

Complete this stub and keep for future reference.

• more than $500 but not over $1,000 on the

required to make monthly, semi-monthly, or

_____________

__ __/__ __/__ __

last day of a quarter’s first or second month,

quarter-monthly tax payments and do not do

Quarter ended

Amount of payment

Form IL-501 and your payment are due on

so, or do not pay the required amount by the

_____________

_____________

or before the 15th day of the following

payment due date. In addition, a bad check

Tax withheld

Check number

month (the quarter’s second or third month).

penalty of $25 will be assessed if you send

__ __/__ __/__ __

• is more than $1,000 at the end of a quarter-

a remittance to the department that is not

monthly period ( i.e., 7th, 15th, 22nd, and

Date filed

IL-501

Illinois Withholding Income Tax Payment

Reset

Write an “X” in the box to indicate which quarter you are

paying.

Complete the following information.

___ ___ ___ ___

1

2

3

4

Tax year

Print

Jan

Apr

July

Oct

___ ___ - ___ ___ ___ ___ ___ ___ ___

___ ___ ___

Feb

May

Aug

Nov

Federal employer identification number

Seq. number

Mar

June

Sept

Dec

Business name

$___________.___

Amount paid:

Number and street address

Make remittance payable to “Illinois Department of Revenue.”

(

)

-

City

State

ZIP

Daytime phone

Mail to: ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19447

IL-501 (R-12/05) IL-492-0053

SPRINGFIELD IL 62794-9447

1

1