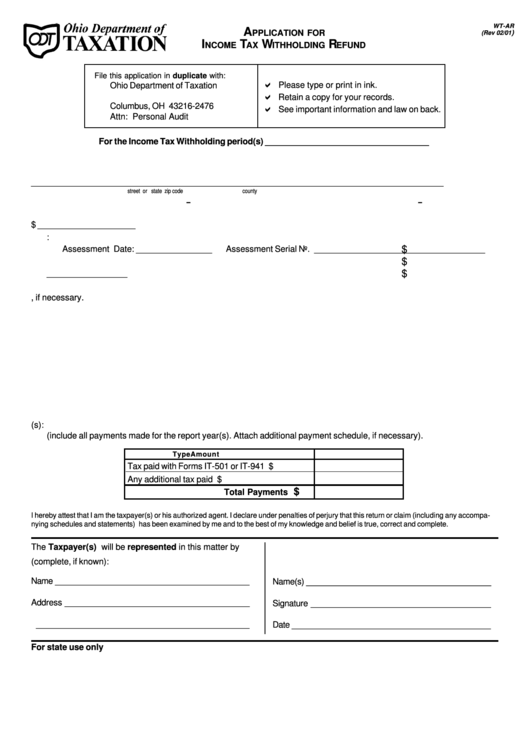

WT-AR

A

PPLICATION FOR

)

(Rev 02/01

I

T

W

R

NCOME

AX

ITHHOLDING

EFUND

File this application in duplicate with:

a

Ohio Department of Taxation

Please type or print in ink.

a

P.O. Box 2476

Retain a copy for your records.

a

Columbus, OH 43216-2476

See important information and law on back.

Attn: Personal Audit

For the Income Tax Withholding period(s) ___________________________________

1. Name of Taxpayer _______________________________________________________________________________

2. Address _______________________________________________________________________________________

street or p.o. box

city

state

zip code

county

-

-

3. Ohio Withholding Account No. ___________________ Federal Employer Identification No. ______________________

4. Total amount of refund claimed $ _____________________

a. By payment of an Illegal or Erroneous Assessment:

$

Assessment Date: ________________

Assessment Serial No. _________________

___________________

$

b. By other Illegal or Erroneous Payment to Treasurer of State .............................................

___________________

$

c. Total Amount of Claim ......................................................................................................

___________________

5. State full and complete reasons for above claim. Attach additional sheets, if necessary.

6. Payment of the amount upon which this refund claim is based was made or included in the following remittance(s):

(include all payments made for the report year(s). Attach additional payment schedule, if necessary).

Type

Amount

Tax paid with Forms IT-501 or IT-941

$

Any additional tax paid

$

$

Total Payments

I hereby attest that I am the taxpayer(s) or his authorized agent. I declare under penalties of perjury that this return or claim (including any accompa-

nying schedules and statements) has been examined by me and to the best of my knowledge and belief is true, correct and complete.

The Taxpayer(s) will be represented in this matter by

(complete, if known):

Name _________________________________________

Name(s) _______________________________________

Address _______________________________________

Signature ______________________________________

_____________________________________________

Date __________________________________________

For state use only

1

1