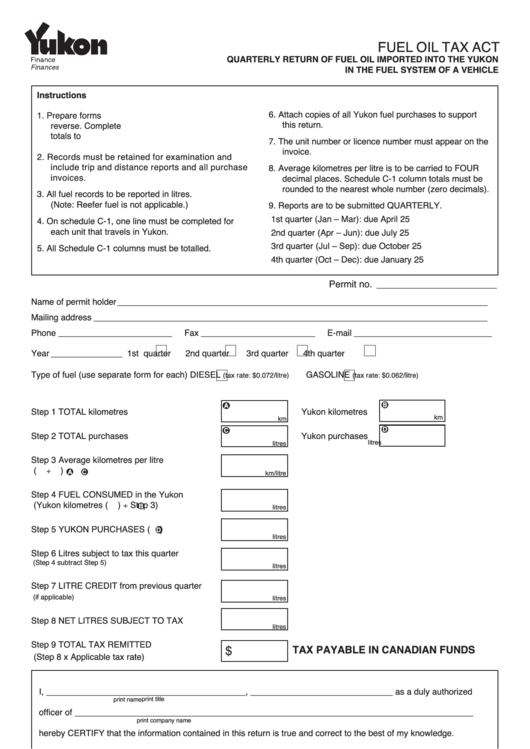

F.O.T.C.

FUEL OIL TAX ACT

QUARTERLY RETURN OF FUEL OIL IMPORTED INTO THE YUKON

IN THE FUEL SYSTEM OF A VEHICLE

Instructions

6. Attach copies of all Yukon fuel purchases to support

1. Prepare forms F.O.T.C. and F.O.T. Schedule C-1 on

this return.

reverse. Complete F.O.T. Schedule C-1 and transfer

totals to F.O.T.C.

7. The unit number or licence number must appear on the

invoice.

2. Records must be retained for examination and

include trip and distance reports and all purchase

8. Average kilometres per litre is to be carried to FOUR

invoices.

decimal places. Schedule C-1 column totals must be

rounded to the nearest whole number (zero decimals).

3. All fuel records to be reported in litres.

(Note: Reefer fuel is not applicable.)

9. Reports are to be submitted QUARTERLY.

1st quarter (Jan – Mar): due April 25

4. On schedule C-1, one line must be completed for

each unit that travels in Yukon.

2nd quarter (Apr – Jun): due July 25

3rd quarter (Jul – Sep): due October 25

5. All Schedule C-1 columns must be totalled.

4th quarter (Oct – Dec): due January 25

Permit no. _______________________

Name of permit holder ______________________________________________________________________________

Mailing address ___________________________________________________________________________________

Phone ________________________

Fax ________________________

E-mail _____________________________

Year _______________

1st quarter

2nd quarter

3rd quarter

4th quarter

Type of fuel (use separate form for each)

DIESEL

GASOLINE

(tax rate: $0.072/litre)

(tax rate: $0.062/litre)

B

A

Step 1 TOTAL kilometres

Yukon kilometres

km

km

D

C

Step 2 TOTAL purchases

Yukon purchases

litres

litres

Step 3 Average kilometres per litre

(

)

÷

A

C

km/litre

Step 4 FUEL CONSUMED in the Yukon

(Yukon kilometres (

) ÷ Step 3)

B

litres

Step 5 YUKON PURCHASES (

)

D

litres

Step 6 Litres subject to tax this quarter

(Step 4 subtract Step 5)

litres

Step 7 LITRE CREDIT from previous quarter

(if applicable)

litres

Step 8 NET LITRES SUBJECT TO TAX

litres

Step 9 TOTAL TAX REMITTED

TAX PAYABLE IN CANADIAN FUNDS

$

(Step 8 x Applicable tax rate)

I, __________________________________________, ______________________________ as a duly authorized

print title

print name

officer of ____________________________________________________________________________________

print company name

hereby CERTIFY that the information contained in this return is true and correct to the best of my knowledge.

Signature

Date

Mail this return to:

Deputy Head, Department of Finance, Government of the Yukon

Box 2703, Whitehorse, Yukon Y1A 2C6

phone (867) 667-5345, fax (867) 456-6709

The personal information requested on this form is collected under the authority of and used for the purpose of administering the Fuel Oil Tax Act.

Questions about the collection or use of this information can be directed to the Yukon Department of Finance, Box 2703, Whitehorse, Yukon, Y1A 2C6,

→

(867) 667-5343.

Continued

YG(1476Q)F2 Rev. 10/2013

1

1 2

2