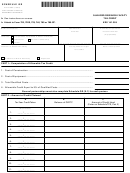

Schedule Qr (Form 41a720qr) Draft - Qualified Research Facility Tax Credit - 2010 Page 2

ADVERTISEMENT

41A720QR (10-10)

Page 2

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

INSTRUCTIONS—QUALIFIED RESEARCH FACILITY TAX CREDIT

The Qualifi ed Research Facility Tax Credit is applied against the individual income tax imposed under KRS 141.020, the

corporation income tax imposed under KRS 141.040 and the limited liability entity tax (LLET) imposed under KRS 141.0401.

The amount of credit claimed against the corporation income tax and the LLET can be different.

The amount of credit claimed from Part I, Line 4 and the resulting balance of credit available must be calculated separately

for income tax and the LLET. If the balance available for the income tax or the LLET reaches zero, no further credit is

allowed against that tax liability. For example, any balance available for income tax cannot be used as a credit against

the LLET nor can any balance available for the LLET be used as a credit against the income tax liability.

For tax years beginning on or after January 1, 2007, Kentucky law permits a credit against the income tax liability and the

LLET liability for the construction of research facilities. “Construction of research facilities” means constructing, remodeling

and equipping facilities in this state or expanding existing facilities in this state for qualifi ed research and includes only

tangible, depreciable property, and does not include any amounts paid or incurred for replacement property. The credit

is available once the tangible, depreciable property is placed in service. “Qualifi ed research” means qualifi ed research

as defi ned in Section 41 of the Internal Revenue Code.

Purpose of Schedule—This schedule is used by taxpayers to determine the credit against the income tax liability and the

LLET liability allowed for completion of research facilities in accordance with KRS 141.395. It is also used to record the

credit claimed each tax year. A copy must be submitted each year until the full credit is utilized or the 10-year carryforward

period has expired. Complete a separate schedule each year that a new project qualifi es.

General Instructions—If the entity type is not listed, check the Other box and list the entity type.

PART I—Computation of Allowable Tax Credit

Line 1—Enter the cost of construction of the qualifi ed cost.*

Line 2—Enter the cost of equipment.*

Line 3—Enter the sum of Line 1 and Line 2.

Line 4—Enter the amount of Line 3 multiplied by 5 percent (.05).

PART II—Current Year Credit

Line 1—LLET Credit—Enter the amount of current year credit claimed against the LLET. This credit cannot reduce the

LLET below the $175 minimum.

Line 2—Corporation Income Tax Credit—Enter the amount of current year credit claimed against the corporation income

tax.

Line 3—Individual Income Tax Credit—Enter the amount of current year credit claimed against the individual income

tax.

PART III—Amount of Credit Claimed

Column A—Enter the month and year the tax credit is taken for this project.

Column B—Enter for year 1 the allowable credit from Part I, Line 4. Enter for each succeeding year the difference between

Column B and Column C for the LLET and income tax.

Note: The 2007 beginning balance of the Qualifi ed Research Facility Tax Credit for LLET will be the same as the balance

for income tax purposes.

Column C—Enter the amount of credit used for that year. If the amount is zero, enter -0-.

* Attach a schedule of the tangible, depreciable property included in Lines 1 and 2 listing the date purchased, date placed

in service, description and cost.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2