Schedule K-38 - Swine Facility Improvement Credit

ADVERTISEMENT

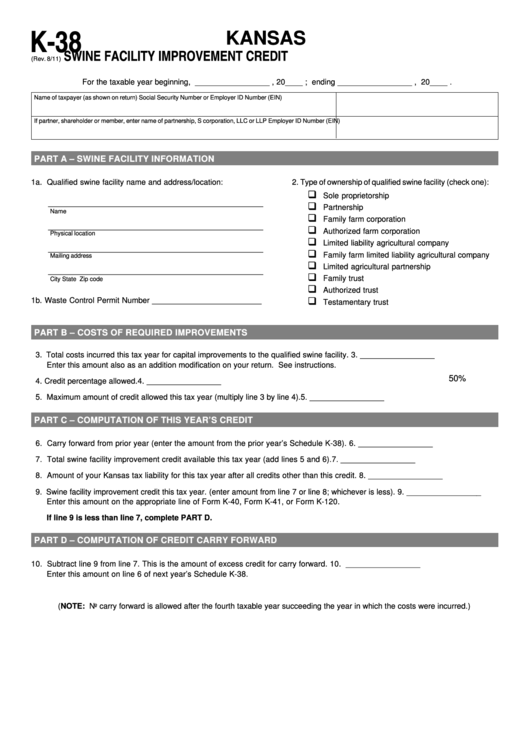

K-38

KANSAS

SWINE FACILITY IMPROVEMENT CREDIT

(Rev. 8/11)

For the taxable year beginning, _________________ , 20____ ; ending _________________ , 20____ .

Name of taxpayer (as shown on return)

Social Security Number or Employer ID Number (EIN)

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP

Employer ID Number (EIN)

PART A – SWINE FACILITY INFORMATION

1a. Qualified swine facility name and address/location:

2.

Type of ownership of qualified swine facility (check one):

‰

Sole proprietorship

‰

_______________________________________________________________

Partnership

Name

‰

Family farm corporation

‰

_______________________________________________________________

Authorized farm corporation

Physical location

‰

Limited liability agricultural company

_______________________________________________________________

‰

Family farm limited liability agricultural company

Mailing address

‰

Limited agricultural partnership

_______________________________________________________________

‰

Family trust

City

State

Zip code

‰

Authorized trust

‰

1b. Waste Control Permit Number _________________________

Testamentary trust

PART B – COSTS OF REQUIRED IMPROVEMENTS

3. Total costs incurred this tax year for capital improvements to the qualified swine facility.

3.

_________________

Enter this amount also as an addition modification on your return. See instructions.

50%

4. Credit percentage allowed.

4.

_________________

5. Maximum amount of credit allowed this tax year (multiply line 3 by line 4).

5.

_________________

PART C – COMPUTATION OF THIS YEAR’S CREDIT

6. Carry forward from prior year (enter the amount from the prior year’s Schedule K-38).

6.

_________________

7. Total swine facility improvement credit available this tax year (add lines 5 and 6).

7.

_________________

8. Amount of your Kansas tax liability for this tax year after all credits other than this credit.

8.

_________________

9. Swine facility improvement credit this tax year. (enter amount from line 7 or line 8; whichever is less).

9.

_________________

Enter this amount on the appropriate line of Form K-40, Form K-41, or Form K-120.

If line 9 is less than line 7, complete PART D.

PART D – COMPUTATION OF CREDIT CARRY FORWARD

10. Subtract line 9 from line 7. This is the amount of excess credit for carry forward.

10. _________________

Enter this amount on line 6 of next year’s Schedule K-38.

(NOTE: No carry forward is allowed after the fourth taxable year succeeding the year in which the costs were incurred.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2