Trinity Form - Sales / Sellers Use / Consumer'S Use / Rental & Leasing Tax Report - Town Of Trinity, Alabama - 2014

ADVERTISEMENT

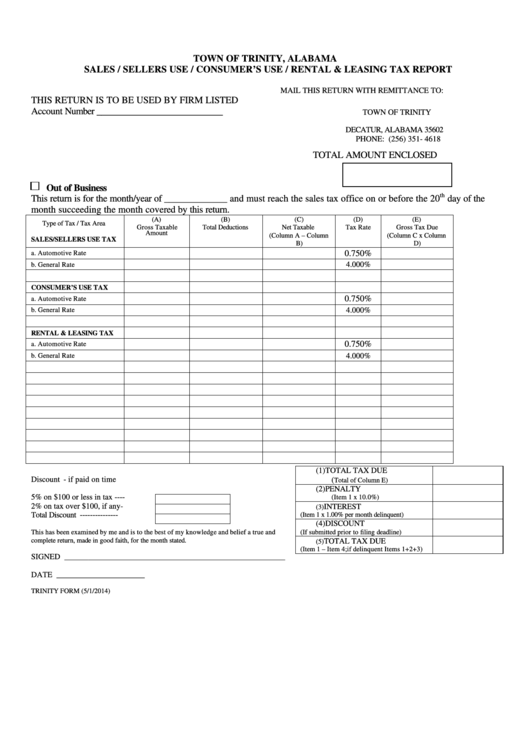

TOWN OF TRINITY, ALABAMA

SALES / SELLERS USE / CONSUMER’S USE / RENTAL & LEASING TAX REPORT

MAIL THIS RETURN WITH REMITTANCE TO:

THIS RETURN IS TO BE USED BY FIRM LISTED

Account Number __________________________

TOWN OF TRINITY

P.O. BOX 302

DECATUR, ALABAMA 35602

PHONE: (256) 351- 4618

TOTAL AMOUNT ENCLOSED

Out of Business

th

This return is for the month/year of _____________ and must reach the sales tax office on or before the 20

day of the

month succeeding the month covered by this return.

(A)

(B)

(C)

(D)

(E)

Type of Tax / Tax Area

Gross Taxable

Total Deductions

Net Taxable

Tax Rate

Gross Tax Due

Amount

(Column A – Column

(Column C x Column

SALES/SELLERS USE TAX

B)

D)

0.750%

a. Automotive Rate

4.000%

b. General Rate

CONSUMER’S USE TAX

0.750%

a. Automotive Rate

4.000%

b. General Rate

RENTAL & LEASING TAX

0.750%

a. Automotive Rate

b. General Rate

4.000%

(1) TOTAL TAX DUE

Discount - if paid on time

(

Total of Column E)

(2) PENALTY

5% on $100 or less in tax ----

(Item 1 x 10.0%)

2% on tax over $100, if any-

INTEREST

(3)

Total Discount ---------------

(Item 1 x 1.00% per month delinquent)

(4) DISCOUNT

(If submitted prior to filing deadline)

This has been examined by me and is to the best of my knowledge and belief a true and

complete return, made in good faith, for the month stated.

TOTAL TAX DUE

(5)

(Item 1 – Item 4;if delinquent Items 1+2+3)

SIGNED _______________________________________________________

DATE ______________________

TRINITY FORM (5/1/2014)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1