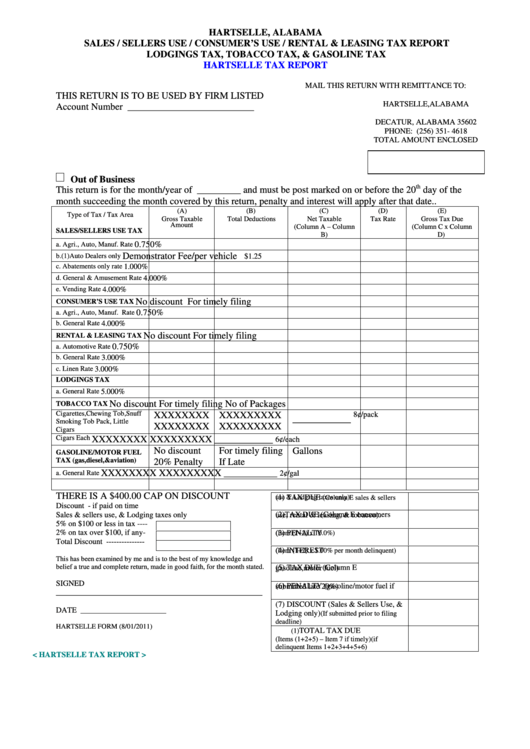

Sales / Sellers Use / Consumer'S Use / Rental & Leasing Tax Report - Hartselle Tax Report

ADVERTISEMENT

HARTSELLE, ALABAMA

SALES / SELLERS USE / CONSUMER’S USE / RENTAL & LEASING TAX REPORT

LODGINGS TAX, TOBACCO TAX, & GASOLINE TAX

HARTSELLE TAX REPORT

MAIL THIS RETURN WITH REMITTANCE TO:

THIS RETURN IS TO BE USED BY FIRM LISTED

HARTSELLE,ALABAMA

Account Number __________________________

P.O. BOX 2028

DECATUR, ALABAMA 35602

PHONE: (256) 351- 4618

TOTAL AMOUNT ENCLOSED

Out of Business

th

This return is for the month/year of _________ and must be post marked on or before the 20

day of the

month succeeding the month covered by this return, penalty and interest will apply after that date..

(A)

(B)

(C)

(D)

(E)

Type of Tax / Tax Area

Gross Taxable

Total Deductions

Net Taxable

Tax Rate

Gross Tax Due

Amount

(Column A – Column

(Column C x Column

SALES/SELLERS USE TAX

B)

D)

0.750%

a. Agri., Auto, Manuf. Rate

Demonstrator

Fee/per vehicle

No.of vehicles_

b.(1)Auto Dealers only

$1.25

1.000%

c. Abatements only rate

4.000%

d. General & Amusement Rate

e. Vending Rate

4.000%

No discount

For timely filing

CONSUMER’S USE TAX

0.750%

a. Agri., Auto, Manuf. Rate

4.000%

b. General Rate

No discount

For timely filing

RENTAL & LEASING TAX

0.750%

a. Automotive Rate

b. General Rate

3.000%

c. Linen Rate

3.000%

LODGINGS TAX

5.000%

a. General Rate

No discount

For timely filing

No of Packages

TOBACCO TAX

Cigarettes,Chewing Tob,Snuff

XXXXXXXX

XXXXXXXXX

8¢/pack

Smoking Tob Pack, Little

XXXXXXXX

XXXXXXXXX

____________

Cigars

Cigars Each

XXXXXXXX

XXXXXXXXX

____________

6¢/each

No discount

For timely filing

GASOLINE/MOTOR FUEL

TAX (gas,diesel,&aviation)

20% Penalty

If Late

Gallons

XXXXXXXX

XXXXXXXXX

___________

a. General Rate

2¢/gal

THERE IS A $400.00 CAP ON DISCOUNT

(1) TAX DUE (

Column E sales & sellers

Discount - if paid on time

use & Lodging taxes only)

Sales & sellers use, & Lodging taxes only

(2)TAX DUE (Column E consumers

5% on $100 or less in tax ----

use, rental & leasing, & tobacco).

2% on tax over $100, if any-

(3) PENALTY

Total Discount ---------------

(Item (1+2) x 10.0%)

(4) INTEREST

(Item (1+2) x 1.00% per month delinquent)

This has been examined by me and is to the best of my knowledge and

belief a true and complete return, made in good faith, for the month stated.

(5) TAX DUE (Column E

gasoline,motor fuel)

SIGNED

(6) PENALTY (gasoline/motor fuel if

_____________________________________________________

submitted late 20%)

(7) DISCOUNT (Sales & Sellers Use, &

DATE ______________________

Lodging only)

(If submitted prior to filing

deadline)

HARTSELLE FORM (8/01/2011)

TOTAL TAX DUE

(1)

(Items (1+2+5) – Item 7 if timely)(if

delinquent Items 1+2+3+4+5+6)

< HARTSELLE TAX REPORT >

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1