Form Fr-500 B - Special Event Registration Application

ADVERTISEMENT

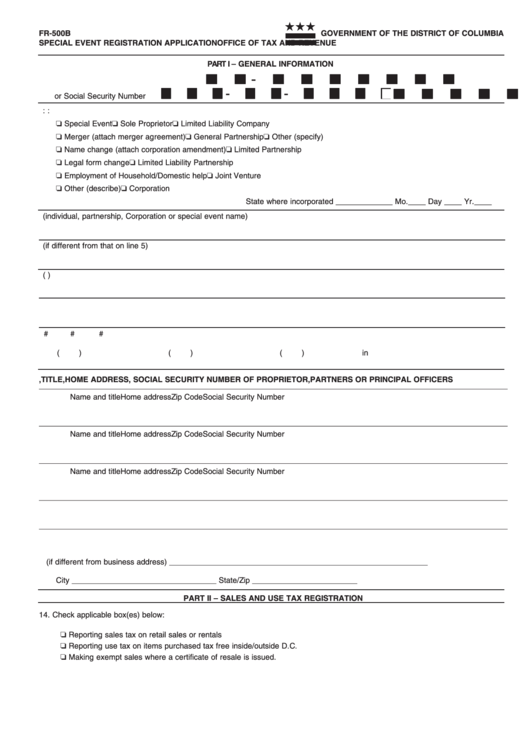

FR-500B

GOVERNMENT OF THE DISTRICT OF COLUMBIA

SPECIAL EVENT REGISTRATION APPLICATION

OFFICE OF TAX AND REVENUE

PART I – GENERAL INFORMATION

-

1. Federal Employer Identification Number

2. NAICS Code

-

-

or Social Security Number

3. Reason for applying:

4. Type of Ownership:

Special Event

Sole Proprietor

Limited Liability Company

Merger (attach merger agreement)

General Partnership

Other (specify)

Name change (attach corporation amendment)

Limited Partnership

Legal form change

Limited Liability Partnership

Employment of Household/Domestic help

Joint Venture

Other (describe)

Corporation

State where incorporated _____________ Mo. ____ Day ____ Yr. ____

5. Business name (individual, partnership, Corporation or special event name)

6. Trade name or promoter (if different from that on line 5)

7. Business address (P.O. Box is not acceptable unless located in a Rural Area)

8. Mailing address

9a. Local business phone #

9b. Main office phone #

10. Fax #

11. Date present business began

(

)

(

)

(

)

in D.C. ______/______/______

mo.

day

yr.

12. NAME, TITLE, HOME ADDRESS, SOCIAL SECURITY NUMBER OF PROPRIETOR, PARTNERS OR PRINCIPAL OFFICERS

___________________________________________________________________________________________________________

Name and title

Home address

Zip Code

Social Security Number

___________________________________________________________________________________________________________

Name and title

Home address

Zip Code

Social Security Number

___________________________________________________________________________________________________________

Name and title

Home address

Zip Code

Social Security Number

___________________________________________________________________________________________________________

13a. Describe fully all of your current or expected business activities within D.C.

___________________________________________________________________________________________________________

b. Current D.C. registration number __________________________________

c. Name and address (if different from business address) ___________________________________________________________

City _________________________________ State/Zip ________________________

PART II – SALES AND USE TAX REGISTRATION

14. Check applicable box(es) below:

15. Date sales began in D.C. ______/______/______

mo.

day

yr.

Reporting sales tax on retail sales or rentals

Reporting use tax on items purchased tax free inside/outside D.C.

Making exempt sales where a certificate of resale is issued.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2