Cg-22 State Form 47862 - Indiana Single Event License - Gross Receipts Report - 2005 Page 3

ADVERTISEMENT

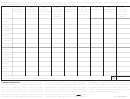

Schedule 2: Enter gross receipts received by your organization for the period July 1 of the previous year through June 30 of the current year, but do not include

any of the charity gaming receipts reported in Column A of Schedule 1. See instructions below.

(a)

(b)

(c)

(d)

(e)

(f)

(g)

(h)

(i)

Contributions,

Membership

Investment

Income from

Income from

Program service

Rental income

Miscellaneous

Total gross

gifts, grants,

dues and

income

sale of assets

retail sales

& other special

Income

income: add

(interest

etc.

assessments

(other than

events income

rows (a)-(h)

dividends, etc.)

Month

inventory)

across

$

$

$

$

$

$

$

$

$

July

1.

2.

August

September

3.

4.

October

5.

November

6.

December

7.

January

February

8.

9.

March

April

10.

11.

May

12.

June

1(i)

$

1. Add all entries in Column (i). Enter total here and on line 2 on page 1 .....................................................................................................

General Instructions:

investment income such as interest and dividends,

on Schedule 1 (attach a separate statement listing the

Enter in Columns (a)-(h) gross

income from the sale of assets (other than inventory),

type of income and the amount.) Add the amounts

income received by the month for your organization,

retail sales (such as food and beverages, less returns

across for each month and total them in Column (i).

but do not include any charity gaming receipts

and allowances), program service revenue and income

Add all Column (i) amounts and enter the total on line

reported in Column A of Schedule 1. This will include

from other special events, rental income and other

1(i). Carry this total to line 2 on page 1.

income from the period of July 1 through June 30 of

gross miscellaneous receipts, such as any other income

the next year, and should include gross income from:

CG-22 Continued

from the charity gaming events not already reported

contributions, membership dues and assessments,

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3