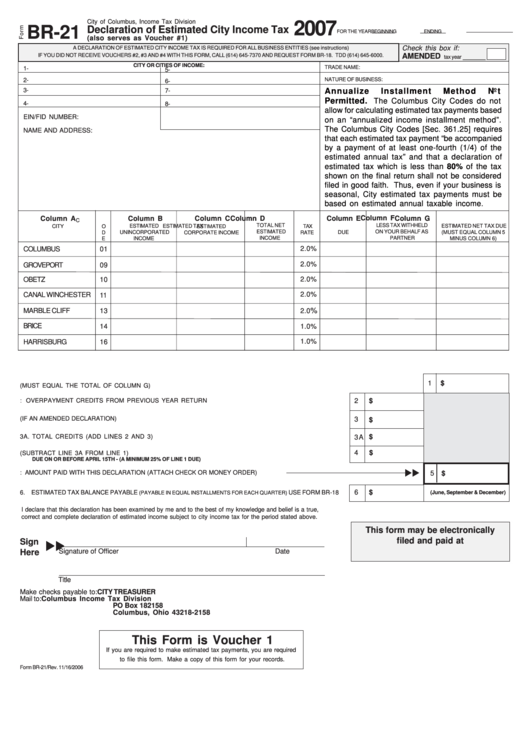

City of Columbus, Income Tax Division

2007

BR-21

Declaration of Estimated City Income Tax

FOR THE YEAR

BEGINNING

ENDING

(also serves as Voucher #1)

A DECLARATION OF ESTIMATED CITY INCOME TAX IS REQUIRED FOR ALL BUSINESS ENTITIES (see instructions)

Check this box if:

IF YOU DID NOT RECEIVE VOUCHERS #2, #3 AND #4 WITH THIS FORM, CALL (614) 645-7370 AND REQUEST FORM BR-18. TDD (614) 645-6000.

AMENDED

______

tax year

CITY OR CITIES OF INCOME:

TRADE NAME:

1-

5-

NATURE OF BUSINESS:

2-

6-

3-

Annualize

Installment

Method

Not

7-

Permitted.

The Columbus City Codes do not

4-

8-

allow for calculating estimated tax payments based

EIN/FID NUMBER:

on an “annualized income installment method”.

The Columbus City Codes [Sec. 361.25] requires

NAME AND ADDRESS:

that each estimated tax payment “be accompanied

by a payment of at least one-fourth (1/4) of the

estimated annual tax” and that a declaration of

estimated tax which is less than 80% of the tax

shown on the final return shall not be considered

filed in good faith. Thus, even if your business is

seasonal, City estimated tax payments must be

based on estimated annual taxable income.

Column B

Column C

Column D

Column F

Column G

Column A

Column E

C

TOTAL NET

LESS TAX WITHHELD

CITY

O

ESTIMATED

ESTIMATED

TAX

ESTIMATED TAX

ESTIMATED NET TAX DUE

ESTIMATED

ON YOUR BEHALF AS

UNINCORPORATED

RATE

DUE

(MUST EQUAL COLUMN 5

D

CORPORATE INCOME

INCOME

PARTNER

E

INCOME

MINUS COLUMN 6)

2.0%

COLUMBUS

01

2.0%

GROVEPORT

09

OBETZ

10

2.0%

2.0%

CANAL WINCHESTER

11

%

MARBLE CLIFF

13

2.0

BRICE

14

1.0%

1.0%

HARRISBURG

16

$

1

1.

TOTAL NET ESTIMATED TAX DUE (MUST EQUAL THE TOTAL OF COLUMN G).......................................................................................

$

2.

LESS: OVERPAYMENT CREDITS FROM PREVIOUS YEAR RETURN...........................................................

2

3.

CREDIT PREVIOUS DECLARATION PAYMENTS (IF AN AMENDED DECLARATION)

.......................................

3

$

3A. TOTAL CREDITS (ADD LINES 2 AND 3)......................................................................................................

$

3A

$

4.

UNPAID BALANCE DUE (SUBTRACT LINE 3A FROM LINE 1).......................................................................

4

DUE ON OR BEFORE APRIL 15TH - (A MINIMUM 25% OF LINE 1 DUE)

5.

LESS: AMOUNT PAID WITH THIS DECLARATION (ATTACH CHECK OR MONEY ORDER)

5

$

$

6. ESTIMATED TAX BALANCE PAYABLE

USE FORM BR-18.....

6

(PAYABLE IN EQUAL INSTALLMENTS FOR EACH QUARTER)

(June, September & December)

I declare that this declaration has been examined by me and to the best of my knowledge and belief is a true,

correct and complete declaration of estimated income subject to city income tax for the period stated above.

This form may be electronically

filed and paid at

Sign

Here

Signature of Officer

Date

Title

Make checks payable to:

CITY TREASURER

Mail to:

Columbus Income Tax Division

PO Box 182158

Columbus, Ohio 43218-2158

This Form is Voucher 1

If you are required to make estimated tax payments, you are required

to file this form. Make a copy of this form for your records.

Form BR-21/Rev. 11/16/2006

1

1