Form N-2 - Declaration Of Estimated Municipal Income Tax On Net Profits

ADVERTISEMENT

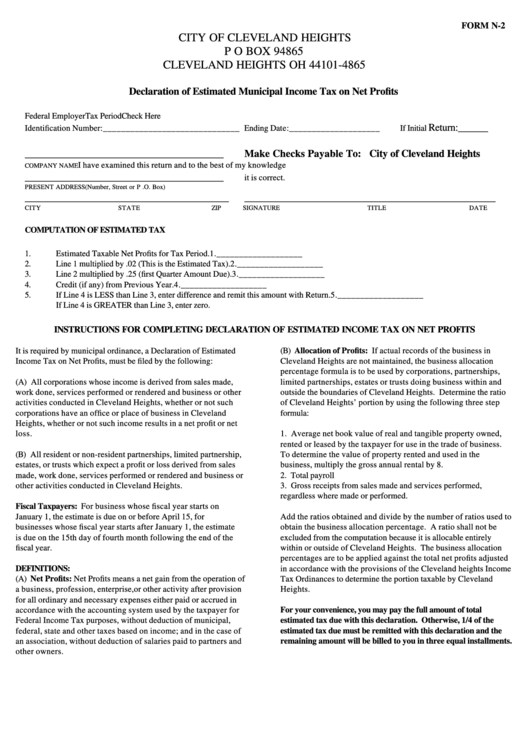

FORM N-2

CITY OF CLEVELAND HEIGHTS

P O BOX 94865

CLEVELAND HEIGHTS OH 44101-4865

Declaration of Estimated Municipal Income Tax on Net Profits

Federal Employer

Tax Period

Check Here

Return:______

Identification Number:______________________________ Ending Date:____________________

If Initial

______________________________________

Make Checks Payable To: City of Cleveland Heights

I have examined this return and to the best of my knowledge

COMPANY NAME

______________________________________

it is correct.

PRESENT ADDRESS(Number, Street or P .O. Box)

_______________________________________

________________________________________________

CITY

STATE

ZIP

SIGNATURE

TITLE

DATE

COMPUTATION OF ESTIMATED TAX

1.

Estimated Taxable Net Profits for Tax Period.

1.___________________

2.

Line 1 multiplied by .02 (This is the Estimated Tax).

2.___________________

3.

Line 2 multiplied by .25 (first Quarter Amount Due).

3.___________________

4.

Credit (if any) from Previous Year.

4.___________________

5.

If Line 4 is LESS than Line 3, enter difference and remit this amount with Return.

5.___________________

If Line 4 is GREATER than Line 3, enter zero.

INSTRUCTIONS FOR COMPLETING DECLARATION OF ESTIMATED INCOME TAX ON NET PROFITS

It is required by municipal ordinance, a Declaration of Estimated

(B) Allocation of Profits: If actual records of the business in

Income Tax on Net Profits, must be filed by the following:

Cleveland Heights are not maintained, the business allocation

percentage formula is to be used by corporations, partnerships,

(A) All corporations whose income is derived from sales made,

limited partnerships, estates or trusts doing business within and

work done, services performed or rendered and business or other

outside the boundaries of Cleveland Heights. Determine the ratio

activities conducted in Cleveland Heights, whether or not such

of Cleveland Heights’ portion by using the following three step

corporations have an office or place of business in Cleveland

formula:

Heights, whether or not such income results in a net profit or net

loss.

1. Average net book value of real and tangible property owned,

rented or leased by the taxpayer for use in the trade of business.

(B) All resident or non-resident partnerships, limited partnership,

To determine the value of property rented and used in the

estates, or trusts which expect a profit or loss derived from sales

business, multiply the gross annual rental by 8.

made, work done, services performed or rendered and business or

2. Total payroll

other activities conducted in Cleveland Heights.

3. Gross receipts from sales made and services performed,

regardless where made or performed.

Fiscal Taxpayers: For business whose fiscal year starts on

January 1, the estimate is due on or before April 15, for

Add the ratios obtained and divide by the number of ratios used to

businesses whose fiscal year starts after January 1, the estimate

obtain the business allocation percentage. A ratio shall not be

is due on the 15th day of fourth month following the end of the

excluded from the computation because it is allocable entirely

fiscal year.

within or outside of Cleveland Heights. The business allocation

percentages are to be applied against the total net profits adjusted

DEFINITIONS:

in accordance with the provisions of the Cleveland heights Income

(A) Net Profits: Net Profits means a net gain from the operation of

Tax Ordinances to determine the portion taxable by Cleveland

a business, profession, enterprise,or other activity after provision

Heights.

for all ordinary and necessary expenses either paid or accrued in

accordance with the accounting system used by the taxpayer for

For your convenience, you may pay the full amount of total

Federal Income Tax purposes, without deduction of municipal,

estimated tax due with this declaration. Otherwise, 1/4 of the

federal, state and other taxes based on income; and in the case of

estimated tax due must be remitted with this declaration and the

an association, without deduction of salaries paid to partners and

remaining amount will be billed to you in three equal installments.

other owners.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1