Form Cr - Maine Corporate Income Tax - Combined Report For Unitary Members

ADVERTISEMENT

*020010400*

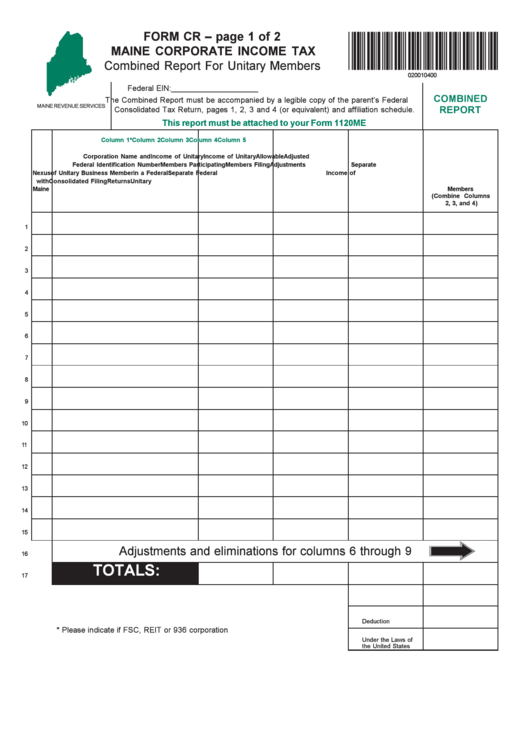

FORM CR – page 1 of 2

MAINE CORPORATE INCOME TAX

Combined Report For Unitary Members

020010400

Federal EIN: ____________________

The Combined Report must be accompanied by a legible copy of the parent’s Federal

MAINE REVENUE SERVICES

Consolidated Tax Return, pages 1, 2, 3 and 4 (or equivalent) and affiliation schedule.

This report must be attached to your Form 1120ME

Column 1*

Column 2

Column 3

Column 4

Column 5

Corporation Name and

Income of Unitary

Income of Unitary

Allowable

Adjusted

Federal Identification Number

Members Participating

Members Filing

Adjustments

Separate

Nexus

of Unitary Business Member

in a Federal

Separate Federal

Income of

with

Consolidated Filing

Returns

Unitary

Maine

Members

(Combine Columns

2, 3, and 4)

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

Adjustments and eliminations for columns 6 through 9

16

TOTALS:

17

18. Special Deductions

19. Unitary NOL

Deduction

* Please indicate if FSC, REIT or 936 corporation

20. Taxable Income

Under the Laws of

the United States

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2