Form Cr - Maine Corporate Income Tax Combined Report For Unitary Members - 2007

ADVERTISEMENT

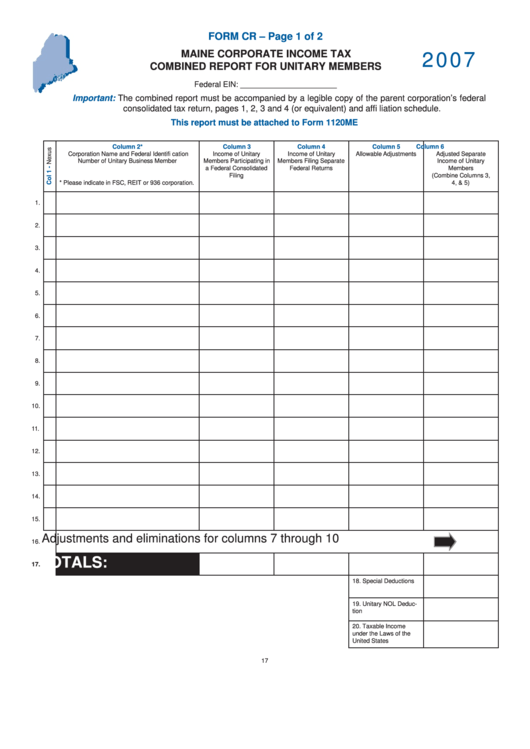

FORM CR – Page 1 of 2

2007

MAINE CORPORATE INCOME TAX

COMBINED REPORT FOR UNITARY MEMBERS

Federal EIN: ______________________

Important:

The combined report must be accompanied by a legible copy of the parent corporation’s federal

consolidated tax return, pages 1, 2, 3 and 4 (or equivalent) and affi liation schedule.

This report must be attached to Form 1120ME

Column 2*

Column 3

Column 4

Column 5

Column 6

Corporation Name and Federal Identifi cation

Income of Unitary

Income of Unitary

Allowable Adjustments

Adjusted Separate

Number of Unitary Business Member

Members Participating in

Members Filing Separate

Income of Unitary

a Federal Consolidated

Federal Returns

Members

Filing

(Combine Columns 3,

* Please indicate in FSC, REIT or 936 corporation.

4, & 5)

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

Adjustments and eliminations for columns 7 through 10

16.

TOTALS:

17.

18. Special Deductions

19. Unitary NOL Deduc-

tion

20. Taxable Income

under the Laws of the

United States

17

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2