Form St-28 - Designated Or Generic Exemption Certificate - Kansas Department Of Revenue

ADVERTISEMENT

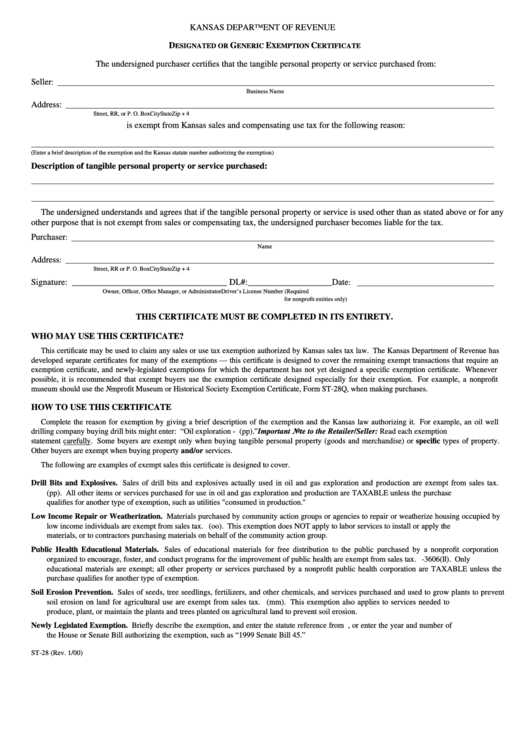

KANSAS DEPARTMENT OF REVENUE

D

G

E

C

ESIGNATED OR

ENERIC

XEMPTION

ERTIFICATE

The undersigned purchaser certifies that the tangible personal property or service purchased from:

Seller

:

Business Name

Address:

Street, RR, or P. O. Box

City

State

Zip + 4

is exempt from Kansas sales and compensating use tax for the following reason:

(Enter a brief description of the exemption and the Kansas statute number authorizing the exemption)

Description of tangible personal property or service purchased:

The undersigned understands and agrees that if the tangible personal property or service is used other than as stated above or for any

other purpose that is not exempt from sales or compensating tax, the undersigned purchaser becomes liable for the tax.

Purchaser

:

Name

Address

:

Street, RR or P. O. Box

City

State

Zip + 4

Signature: ___________________________________ DL#: ___________________ Date

:

Owner, Officer, Office Manager, or Administrator

Driver’s License Number (Required

for nonprofit entities only)

THIS CERTIFICATE MUST BE COMPLETED IN ITS ENTIRETY.

WHO MAY USE THIS CERTIFICATE?

This certificate may be used to claim any sales or use tax exemption authorized by Kansas sales tax law. The Kansas Department of Revenue has

developed separate certificates for many of the exemptions — this certificate is designed to cover the remaining exempt transactions that require an

exemption certificate, and newly-legislated exemptions for which the department has not yet designed a specific exemption certificate. Whenever

possible, it is recommended that exempt buyers use the exemption certificate designed especially for their exemption. For example, a nonprofit

museum should use the Nonprofit Museum or Historical Society Exemption Certificate, Form ST-28Q, when making purchases.

HOW TO USE THIS CERTIFICATE

Complete the reason for exemption by giving a brief description of the exemption and the Kansas law authorizing it. For example, an oil well

drilling company buying drill bits might enter: “Oil exploration - K.S.A. 79-3606(pp).” Important Note to the Retailer/Seller: Read each exemption

statement carefully. Some buyers are exempt only when buying tangible personal property (goods and merchandise) or specific types of property.

Other buyers are exempt when buying property and/or services.

The following are examples of exempt sales this certificate is designed to cover.

Drill Bits and Explosives. Sales of drill bits and explosives actually used in oil and gas exploration and production are exempt from sales tax.

K.S.A. 79-3606(pp). All other items or services purchased for use in oil and gas exploration and production are TAXABLE unless the purchase

qualifies for another type of exemption, such as utilities "consumed in production."

Low Income Repair or Weatherization. Materials purchased by community action groups or agencies to repair or weatherize housing occupied by

low income individuals are exempt from sales tax. K.S.A. 79-3606(oo). This exemption does NOT apply to labor services to install or apply the

materials, or to contractors purchasing materials on behalf of the community action group.

Public Health Educational Materials. Sales of educational materials for free distribution to the public purchased by a nonprofit corporation

organized to encourage, foster, and conduct programs for the improvement of public health are exempt from sales tax. K.S.A. 79-3606(ll). Only

educational materials are exempt; all other property or services purchased by a nonprofit public health corporation are TAXABLE unless the

purchase qualifies for another type of exemption.

Soil Erosion Prevention. Sales of seeds, tree seedlings, fertilizers, and other chemicals, and services purchased and used to grow plants to prevent

soil erosion on land for agricultural use are exempt from sales tax. K.S.A. 79-3606(mm). This exemption also applies to services needed to

produce, plant, or maintain the plants and trees planted on agricultural land to prevent soil erosion.

Newly Legislated Exemption. Briefly describe the exemption, and enter the statute reference from K.S.A. 79-3606, or enter the year and number of

the House or Senate Bill authorizing the exemption, such as “1999 Senate Bill 45.”

ST-28 (Rev. 1/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1