Form St-28j - Interstate Common Carrier Exemption Certificate - Kansas Department Of Revenue

ADVERTISEMENT

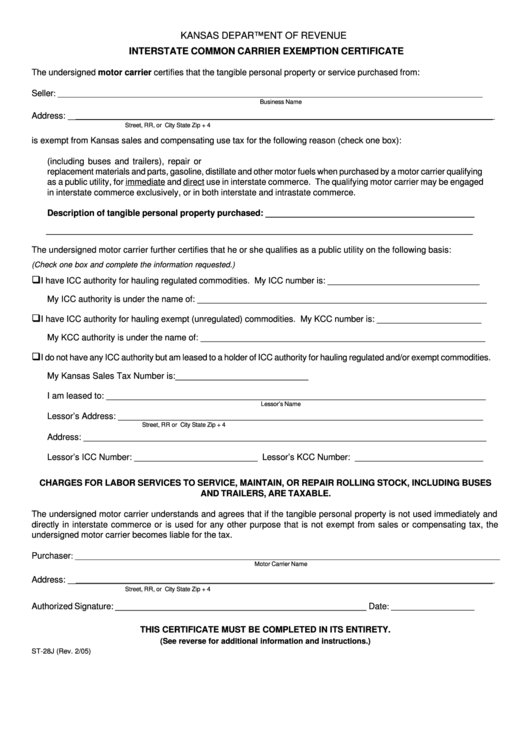

KANSAS DEPARTMENT OF REVENUE

INTERSTATE COMMON CARRIER EXEMPTION CERTIFICATE

The undersigned motor carrier certifies that the tangible personal property or service purchased from:

Seller

:

_________________________________________________________________________________________________

Business Name

Address:

_________________________________________________________________________________________________

Street, RR, or P.O. Box

City

State

Zip + 4

is exempt from Kansas sales and compensating use tax for the following reason (check one box):

K.A.R. 92-19-28 and K.A.R. 92-20-18 exempt the sale of rolling stock (including buses and trailers), repair or

replacement materials and parts, gasoline, distillate and other motor fuels when purchased by a motor carrier qualifying

as a public utility, for immediate and direct use in interstate commerce. The qualifying motor carrier may be engaged

in interstate commerce exclusively, or in both interstate and intrastate commerce.

Description of tangible personal property purchased: ____________________________________________

__________________________________________________________________________________________

The undersigned motor carrier further certifies that he or she qualifies as a public utility on the following basis:

(Check one box and complete the information requested.)

G

I have ICC authority for hauling regulated commodities. My ICC number is: ________________________________

My ICC authority is under the name of: _____________________________________________________________

G

I have ICC authority for hauling exempt (unregulated) commodities. My KCC number is: ______________________

My KCC authority is under the name of: ____________________________________________________________

G

I do not have any ICC authority but am leased to a holder of ICC authority for hauling regulated and/or exempt commodities.

My Kansas Sales Tax Number is: ____________________________

I am leased to: ________________________________________________________________________________

Lessor’s Name

Lessor’s Address: _____________________________________________________________________________

Street, RR or P.O. Box

City

State

Zip + 4

Address: _____________________________________________________________________________________

Lessor’s ICC Number: __________________________ Lessor’s KCC Number: ___________________________

CHARGES FOR LABOR SERVICES TO SERVICE, MAINTAIN, OR REPAIR ROLLING STOCK, INCLUDING BUSES

AND TRAILERS, ARE TAXABLE.

The undersigned motor carrier understands and agrees that if the tangible personal property is not used immediately and

directly in interstate commerce or is used for any other purpose that is not exempt from sales or compensating tax, the

undersigned motor carrier becomes liable for the tax.

Purchaser

: _________________________________________________________________________________________________

Motor Carrier Name

Address:

_________________________________________________________________________________________________

Street, RR, or P.O. Box

City

State

Zip + 4

Authorized Signature: _____________________________________________________

Date

: ___________________

THIS CERTIFICATE MUST BE COMPLETED IN ITS ENTIRETY.

(See reverse for additional information and instructions.)

ST-28J (Rev. 2/05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2