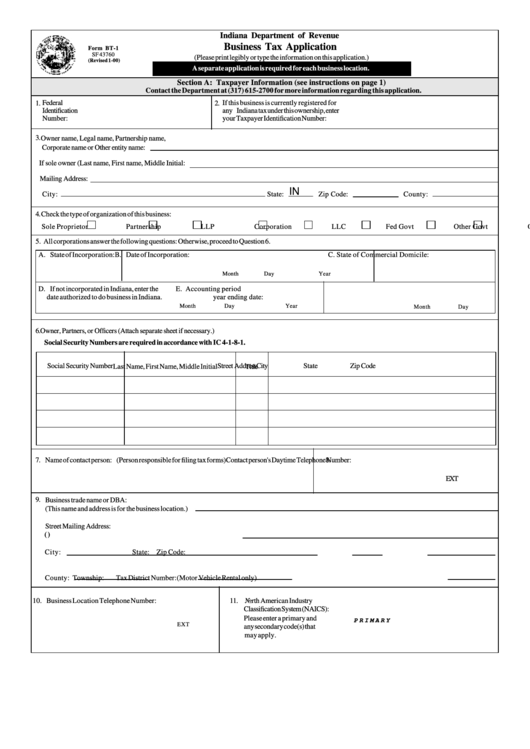

Indiana Department of Revenue

Business Tax Application

Form BT-1

SF 43760

(Please print legibly or type the information on this application.)

(Revised 1-00)

A separate application is required for each business location.

Section A: Taxpayer Information (see instructions on page 1)

Contact the Department at (317) 615-2700 for more information regarding this application.

Federal

If this business is currently registered for

1.

2.

Identification

any Indiana tax under this ownership, enter

Number:

your Taxpayer Identification Number:

3.

Owner name, Legal name, Partnership name,

Corporate name or Other entity name:

If sole owner (Last name, First name, Middle Initial:

Mailing Address:

IN

City:

State:

Zip Code:

County:

4.

Check the type of organization of this business:

Sole Proprietor

Partnership

LLP

Corporation

LLC

Fed Govt

Other Govt

Other

5. All corporations answer the following questions: Otherwise, proceed to Question 6.

A. State of Incorporation:

B. Date of Incorporation:

C. State of Commercial Domicile:

Month

Day

Year

D. If not incorporated in Indiana, enter the

E. Accounting period

.

date authorized to do business in Indiana.

year ending date:

Month

Day

Year

Month

Day

6. Owner, Partners, or Officers (Attach separate sheet if necessary.)

Social Security Numbers are required in accordance with IC 4-1-8-1.

Social Security Number

Street Address

City

State

Zip Code

Last Name, First Name, Middle Initial

Title

7.

Name of contact person: (Person responsible for filing tax forms)

8.

Contact person's Daytime Telephone Number:

EXT

9.

Business trade name or DBA:

(This name and address is for the business location.)

Street Mailing Address:

(P.O. Box numbers cannot be used as a business location address.)

City:

State:

Zip Code:

County:

Township:

Tax District Number:(Motor Vehicle Rental only)

10. Business Location Telephone Number:

11.

North American Industry

Classification System (NAICS):

Please enter a primary and

P R I M A R Y

EXT

any secondary code(s) that

may apply.

1

1 2

2 3

3 4

4