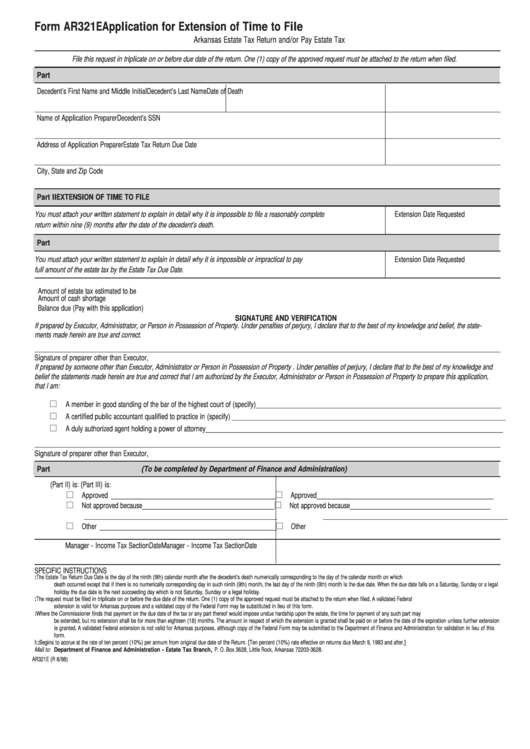

Form AR321E

Application for Extension of Time to File

Arkansas Estate Tax Return and/or Pay Estate Tax

File this request in triplicate on or before due date of the return. One (1) copy of the approved request must be attached to the return when filed.

Part I.

IDENTIFICATION

Decedent’s First Name and Middle Initial

Decedent’s Last Name

Date of Death

Name of Application Preparer

Decedent’s SSN

Address of Application Preparer

Estate Tax Return Due Date

City, State and Zip Code

Part II

EXTENSION OF TIME TO FILE

You must attach your written statement to explain in detail why it is impossible to file a reasonably complete

Extension Date Requested

return within nine (9) months after the date of the decedent’s death.

Part III. EXTENSION OF TIME TO PAY

You must attach your written statement to explain in detail why it is impossible or impractical to pay

Extension Date Requested

full amount of the estate tax by the Estate Tax Due Date.

Amount of estate tax estimated to be due .........................................................................................................................................................

_________________

Amount of cash shortage claimed.....................................................................................................................................................................

_________________

Balance due (Pay with this application). ...........................................................................................................................................................

_________________

SIGNATURE AND VERIFICATION

If prepared by Executor, Administrator, or Person in Possession of Property. Under penalties of perjury, I declare that to the best of my knowledge and belief, the state-

ments made herein are true and correct.

Signature of preparer other than Executor, etc.

Title

Date

If prepared by someone other than Executor, Administrator or Person in Possession of Property . Under penalties of perjury, I declare that to the best of my knowledge and

belief the statements made herein are true and correct that I am authorized by the Executor, Administrator or Person in Possession of Property to prepare this application,

that I am:

A member in good standing of the bar of the highest court of (specify) _____________________________________________________________

A certified public accountant qualified to practice in (specify) ____________________________________________________________________

A duly authorized agent holding a power of attorney __________________________________________________________________________

Signature of preparer other than Executor, etc.

Title

Date

Part IV. NOTICE TO APPLICANT (To be completed by Department of Finance and Administration)

1.

The application for extension to file (Part II) is:

2.

The application for extension of time to pay (Part III) is:

Approved _________________________________________

Approved____________________________________________

Not approved because_________________________________

Not approved because___________________________________

________________________________________________

______________________________________________

Other ____________________________________________

Other

Manager - Income Tax Section

Date

Manager - Income Tax Section

Date

SPECIFIC INSTRUCTIONS

I.

Estate Tax Return Due Date: The Estate Tax Return Due Date is the day of the ninth (9th) calendar month after the decedent’ s death numerically corresponding to the day of the calendar month on which

death occurred except that if there is no numerically corresponding day in such ninth (9th) month, the last day of the ninth (9th) month is the due date. When the due date falls on a Saturday, Sunday or a legal

holiday the due date is the next succeeding day which is not Saturday, Sunday or a legal holiday.

II.

Extension of Time to File: The request must be filed in triplicate on or before the due date of the return. One (1) copy of the approved request must be attached to the return when filed. A validated Federal

extension is valid for Arkansas purposes and a validated copy of the Federal Form may be substituted in lieu of this form.

III.

Extension of Time to Pay: Where the Commissioner finds that payment on the due date of the tax or any part thereof would impose undue hardship upon the estate, the time for payment of any such part may

be extended, but no extension shall be for more than eighteen (18) months. The amount in respect of which the extension is granted shall be paid on or before the date of the expiration unless further extension

is granted. A validated Federal extension is not valid for Arkansas purposes, although copy of the Federal Form may be submitted to the Department of Finance and Administration for validation in lieu of this

form.

IV.

Interest:: Begins to accrue at the rate of ten percent (10%) per annum from original due date of the Return. [Ten percent (10%) rate effective on returns due March 9, 1983 and after.]

Mail to: Department of Finance and Administration - Estate Tax Branch, P. O. Box 3628, Little Rock, Arkansas 72203-3628.

AR321E (R 8/98)

1

1