Form St-124 - Idaho Sales Tax Declaration Sample

ADVERTISEMENT

State Tax Commission

Publication

Promoter-sPonsored

643

events

Idaho State Tax Commission

Rev.

06-08-20120

800 Park Blvd., Plaza IV

Boise, ID 83712-7742

tax.idaho.gov

If you organize an event where two or more retailers

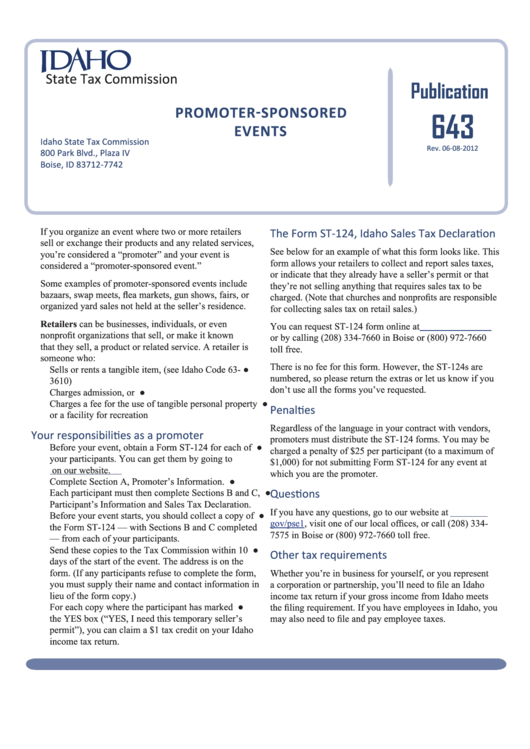

The Form ST-124, Idaho Sales Tax Declaration

sell or exchange their products and any related services,

See below for an example of what this form looks like. This

you’re considered a “promoter” and your event is

form allows your retailers to collect and report sales taxes,

considered a “promoter-sponsored event.”

or indicate that they already have a seller’s permit or that

Some examples of promoter-sponsored events include

they’re not selling anything that requires sales tax to be

bazaars, swap meets, flea markets, gun shows, fairs, or

charged. (Note that churches and nonprofits are responsible

organized yard sales not held at the seller’s residence.

for collecting sales tax on retail sales.)

Retailers can be businesses, individuals, or even

You can request ST-124 form online at

tax.idaho.gov/pse2

nonprofit organizations that sell, or make it known

or by calling (208) 334-7660 in Boise or (800) 972-7660

that they sell, a product or related service. A retailer is

toll free.

someone who:

There is no fee for this form. However, the ST-124s are

●

Sells or rents a tangible item, (see Idaho Code 63-

numbered, so please return the extras or let us know if you

3610)

don’t use all the forms you’ve requested.

●

Charges admission, or

●

Charges a fee for the use of tangible personal property

Penalties

or a facility for recreation

Regardless of the language in your contract with vendors,

Your responsibilities as a promoter

promoters must distribute the ST-124 forms. You may be

●

Before your event, obtain a Form ST-124 for each of

charged a penalty of $25 per participant (to a maximum of

your participants. You can get them by going to

$1,000) for not submitting Form ST-124 for any event at

tax.idaho.gov/pse2

on our website.

which you are the promoter.

●

Complete Section A, Promoter’s Information.

Questions

●

Each participant must then complete Sections B and C,

Participant’s Information and Sales Tax Declaration.

If you have any questions, go to our website at

tax.idaho.

●

Before your event starts, you should collect a copy of

gov/pse1, visit one of our local offices, or call (208) 334-

the Form ST-124 — with Sections B and C completed

7575 in Boise or (800) 972-7660 toll free.

— from each of your participants.

●

Send these copies to the Tax Commission within 10

Other tax requirements

days of the start of the event. The address is on the

form. (If any participants refuse to complete the form,

Whether you’re in business for yourself, or you represent

you must supply their name and contact information in

a corporation or partnership, you’ll need to file an Idaho

lieu of the form copy.)

income tax return if your gross income from Idaho meets

●

For each copy where the participant has marked

the filing requirement. If you have employees in Idaho, you

the YES box (“YES, I need this temporary seller’s

may also need to file and pay employee taxes.

permit”), you can claim a $1 tax credit on your Idaho

income tax return.

tax.idaho.gov

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2