Form St 07-25 - Sales Tax - 2007

ADVERTISEMENT

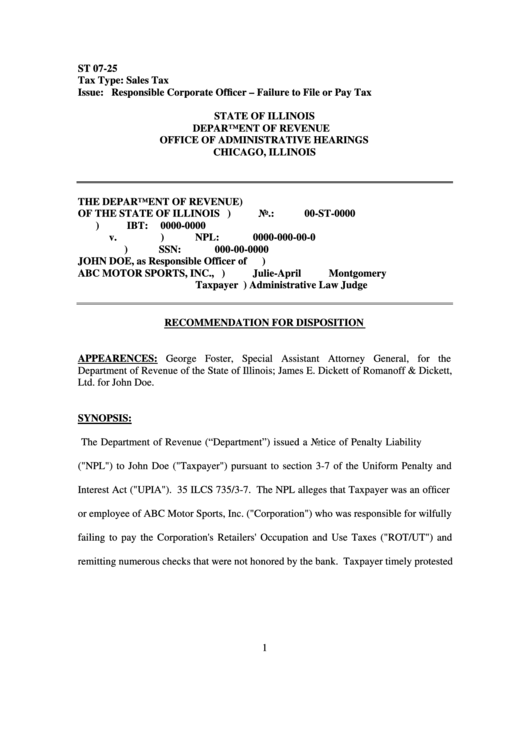

ST 07-25

Tax Type:

Sales Tax

Issue:

Responsible Corporate Officer – Failure to File or Pay Tax

STATE OF ILLINOIS

DEPARTMENT OF REVENUE

OFFICE OF ADMINISTRATIVE HEARINGS

CHICAGO, ILLINOIS

THE DEPARTMENT OF REVENUE

)

OF THE STATE OF ILLINOIS

)

No.:

00-ST-0000

)

IBT:

0000-0000

v.

)

NPL: 0000-000-00-0

)

SSN:

000-00-0000

JOHN DOE, as Responsible Officer of

)

ABC MOTOR SPORTS, INC.,

)

Julie-April Montgomery

Taxpayer

)

Administrative Law Judge

RECOMMENDATION FOR DISPOSITION

APPEARENCES: George Foster, Special Assistant Attorney General, for the

Department of Revenue of the State of Illinois; James E. Dickett of Romanoff & Dickett,

Ltd. for John Doe.

SYNOPSIS:

The Department of Revenue (“Department”) issued a Notice of Penalty Liability

("NPL") to John Doe ("Taxpayer") pursuant to section 3-7 of the Uniform Penalty and

Interest Act ("UPIA"). 35 ILCS 735/3-7. The NPL alleges that Taxpayer was an officer

or employee of ABC Motor Sports, Inc. ("Corporation") who was responsible for wilfully

failing to pay the Corporation's Retailers' Occupation and Use Taxes ("ROT/UT") and

remitting numerous checks that were not honored by the bank. Taxpayer timely protested

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11