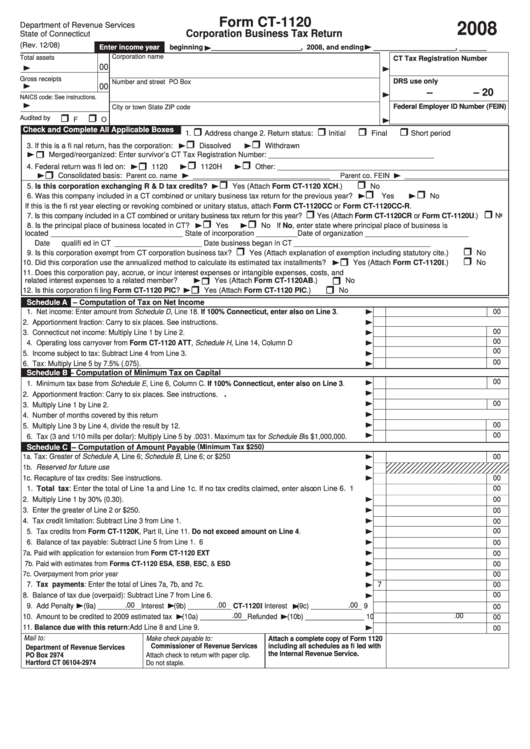

Form Ct-1120 - Corporation Business Tax Return - 2008

ADVERTISEMENT

Form CT-1120

2008

Department of Revenue Services

Corporation Business Tax Return

State of Connecticut

(Rev. 12/08)

Enter income year

bbeginning

_______________________, 2008, and ending

_____________________, _______

Corporation name

Total assets

CT Tax Registration Number

00

Gross receipts

DRS use only

Number and street

PO Box

00

–

– 20

NAICS code: See instructions.

Federal Employer ID Number (FEIN)

City or town

State

ZIP code

Audited by

F

O

Check and Complete All Applicable Boxes

1.

Address change

2. Return status:

Initial

Final

Short period

3. If this is a fi nal return, has the corporation:

Dissolved

Withdrawn

Merged/reorganized: Enter survivor’s CT Tax Registration Number: ________________________________________

4. Federal return was fi led on:

1120

1120H

Other: ________________________________________________________

Consolidated basis:

Parent co. name

_____________________________________

Parent co. FEIN

____________________________

5. Is this corporation exchanging R & D tax credits?

Yes (Attach Form CT-1120 XCH.)

No

6. Was this company included in a CT combined or unitary business tax return for the previous year?

Yes

No

If this is the fi rst year electing or revoking combined or unitary status, attach Form CT-1120CC or Form CT-1120CC-R.

7. Is this company included in a CT combined or unitary business tax return for this year?

Yes (Attach Form CT-1120CR or Form CT-1120U.)

No

8. Is the principal place of business located in CT?

Yes

No If No, enter state where principal place of business is

located ________________________________ State of incorporation __________Date of organization _________________________

Date qualifi ed in CT _____________________ Date business began in CT _________________________________

9. Is this corporation exempt from CT corporation business tax?

Yes (Attach explanation of exemption including statutory cite.)

No

10. Did this corporation use the annualized method to calculate its estimated tax installments?

Yes (Attach Form CT-1120I.)

No

11. Does this corporation pay, accrue, or incur interest expenses or intangible expenses, costs, and

related interest expenses to a related member?

Yes (Attach Form CT-1120AB.)

No

12. Is this corporation fi ling Form CT-1120 PIC?

Yes (Attach Form CT-1120 PIC.)

No

Schedule A

– Computation of Tax on Net Income

00

1. Net income: Enter amount from Schedule D, Line 18. If 100% Connecticut, enter also on Line 3. ...........

1

2. Apportionment fraction: Carry to six places. See instructions. ......................................................................

2

0.

00

3. Connecticut net income: Multiply Line 1 by Line 2. ........................................................................................

3

00

4. Operating loss carryover from Form CT-1120 ATT, Schedule H, Line 14, Column D ...................................

4

00

5. Income subject to tax: Subtract Line 4 from Line 3. .......................................................................................

5

00

6. Tax: Multiply Line 5 by 7.5% (.075). ...............................................................................................................

6

Schedule B

– Computation of Minimum Tax on Capital

00

1. Minimum tax base from Schedule E, Line 6, Column C. If 100% Connecticut, enter also on Line 3. ........

1

.

2. Apportionment fraction: Carry to six places. See instructions. ......................................................................

2

0

00

3. Multiply Line 1 by Line 2. ...............................................................................................................................

3

4. Number of months covered by this return ......................................................................................................

4

00

5. Multiply Line 3 by Line 4, divide the result by 12. ..........................................................................................

5

00

6. Tax (3 and 1/10 mills per dollar): Multiply Line 5 by .0031. Maximum tax for Schedule B is $1,000,000. ......

6

( Minimum Tax $250 )

Schedule C

– Computation of Amount Payable

1a.

Tax: Greater of Schedule A, Line 6; Schedule B, Line 6; or $250 ...................................................................

1a

00

1b.

Reserved for future use ...................................................................................................................................

1b

1c. Recapture of tax credits: See instructions. .....................................................................................................

1c

00

1. Total tax: Enter the total of Line 1a and Line 1c. If no tax credits claimed, enter also on Line 6. ........

00

1

2. Multiply Line 1 by 30% (0.30). .........................................................................................................................

2

00

3. Enter the greater of Line 2 or $250. ................................................................................................................

3

00

4. Tax credit limitation: Subtract Line 3 from Line 1. ...........................................................................................

4

00

00

5. Tax credits from Form CT-1120K, Part II, Line 11. Do not exceed amount on Line 4. ................................

5

6. Balance of tax payable: Subtract Line 5 from Line 1.

6

...........................................................................................

00

7a. Paid with application for extension from Form CT-1120 EXT ...................................................................................

7a

00

7b. Paid with estimates from Forms CT-1120 ESA, ESB, ESC, & ESD ........................................................................

7b

00

7c. Overpayment from prior year .....................................................................................................................................

7c

00

7. Tax payments: Enter the total of Lines 7a, 7b, and 7c. ......................................................................................

7

00

00

8. Balance of tax due (overpaid): Subtract Line 7 from Line 6. ...........................................................................

8

.00

.00

.00

9. Add Penalty

(9a) ___________ Interest

(9b) ___________ CT-1120I Interest

(9c) _____________

9

00

.00

.00

10. Amount to be credited to 2009 estimated tax

(10a) ____________Refunded

(10b) _______________

10

00

11. Balance due with this return: Add Line 8 and Line 9. ..................................................................................

11

00

Mail to:

Make check payable to:

Attach a complete copy of Form 1120

Commissioner of Revenue Services

including all schedules as fi led with

Department of Revenue Services

the Internal Revenue Service.

PO Box 2974

Attach check to return with paper clip.

Hartford CT 06104-2974

Do not staple.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2