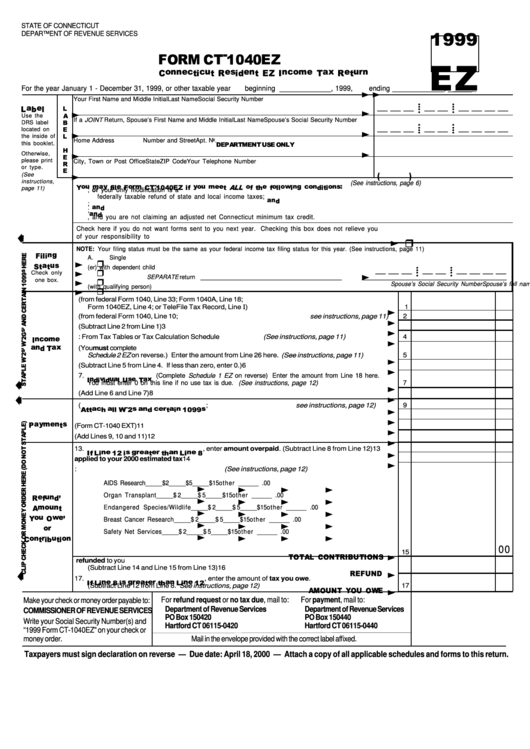

Form Ct-1040ez - Connecticut Resident Ez Income Tax Return - 1999

ADVERTISEMENT

STATE OF CONNECTICUT

DEPARTMENT OF REVENUE SERVICES

For the year January 1 - December 31, 1999, or other taxable year

beginning _____________, 1999,

ending _____________, ______.

Your First Name and Middle Initial

Last Name

Social Security Number

• •

• •

• •

• •

Use the

If a JOINT Return, Spouse’s First Name and Middle Initial

Last Name

Spouse’s Social Security Number

DRS label

• •

• •

located on

• •

• •

the inside of

Home Address

Number and Street

Apt. No.

this booklet.

Otherwise,

please print

City, Town or Post Office

State

ZIP Code

Your Telephone Number

or type.

(See

instructions,

(See instructions, page 6)

page 11)

A. You have no modifications to Federal Adjusted Gross Income for Connecticut income tax purposes; or your only modification is a

federally taxable refund of state and local income taxes;

B. You were a resident of Connecticut for the entire taxable year;

C. You are not claiming credit for income taxes paid to another jurisdiction;

D. You do not have a federal alternative minimum tax liability, and you are not claiming an adjusted net Connecticut minimum tax credit.

Check here if you do not want forms sent to you next year. Checking this box does not relieve you

of your responsibility to file............................................................................................................

NOTE: Your filing status must be the same as your federal income tax filing status for this year. (See instructions, page 11)

A.

Single

B.

Married filing joint return or Qualifying widow(er) with dependent child

• •

• •

Check only

• •

• •

C.

Married filing SEPARATE return __________________________________________

___________________________________________

one box.

Spouse’s full name

Spouse’s Social Security Number

D.

Head of household (with qualifying person)

1. Federal Adjusted Gross Income (from federal Form 1040, Line 33; Form 1040A, Line 18;

Form 1040EZ, Line 4; or TeleFile Tax Record, Line

I

)

1

2. Refunds of state and local income taxes (from federal Form 1040, Line 10; see instructions, page 11)

2

3. Connecticut Adjusted Gross Income (Subtract Line 2 from Line 1)

3

4. Income Tax: From Tax Tables or Tax Calculation Schedule (See instructions, page 11)

4

5. Credit for property taxes paid on your primary residence and/or motor vehicle. (You must complete

Schedule 2 EZ on reverse.) Enter the amount from Line 26 here. (See instructions, page 11)

5

6. Connecticut Income Tax (Subtract Line 5 from Line 4. If less than zero, enter 0.)

6

7.

(Complete Schedule 1 EZ on reverse) Enter the amount from Line 18 here.

You must enter 0 on this line if no use tax is due. (See instructions, page 12)

7

8. Total Tax (Add Line 6 and Line 7)

8

9. Connecticut tax withheld (

; see instructions, page 12)

9

10. All 1999 estimated tax payments and any overpayments applied from a prior year

10

11. Payments made with extension request (Form CT-1040 EXT)

11

12. Total payments (Add Lines 9, 10 and 11)

12

13.

, enter amount overpaid. (Subtract Line 8 from Line 12)

13

14. Amount of Line 13 you want applied to your 2000 estimated tax

14

15. Amount of Line 13 you want to contribute to: (See instructions, page 12)

AIDS Research

_____ $ 2

_____ $ 5

_____ $ 1 5

other ______ . 0 0

Organ Transplant

_____ $ 2

_____ $ 5

_____ $ 1 5

other ______ . 0 0

Endangered Species/Wildlife

_____ $ 2

_____ $ 5

_____ $ 1 5

other ______ . 0 0

Breast Cancer Research

_____ $ 2

_____ $ 5

_____ $ 1 5

other ______ . 0 0

Safety Net Services

_____ $ 2

_____ $ 5

_____ $ 1 5

other ______ . 0 0

00

15

16. Amount of Line 13 you want refunded to you

(Subtract Line 14 and Line 15 from Line 13)

16

17.

, enter the amount of tax you owe.

(Subtract Line 12 from Line 8. See instructions, page 12)

17

For refund request or no tax due, mail to:

For payment, mail to:

Make your check or money order payable to:

Department of Revenue Services

Department of Revenue Services

COMMISSIONER OF REVENUE SERVICES

PO Box 150420

PO Box 150440

Write your Social Security Number(s) and

Hartford CT 06115-0420

Hartford CT 06115-0440

“1999 Form CT-1040EZ" on your check or

money order.

Mail in the envelope provided with the correct label affixed.

Taxpayers must sign declaration on reverse — Due date: April 18, 2000 — Attach a copy of all applicable schedules and forms to this return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2