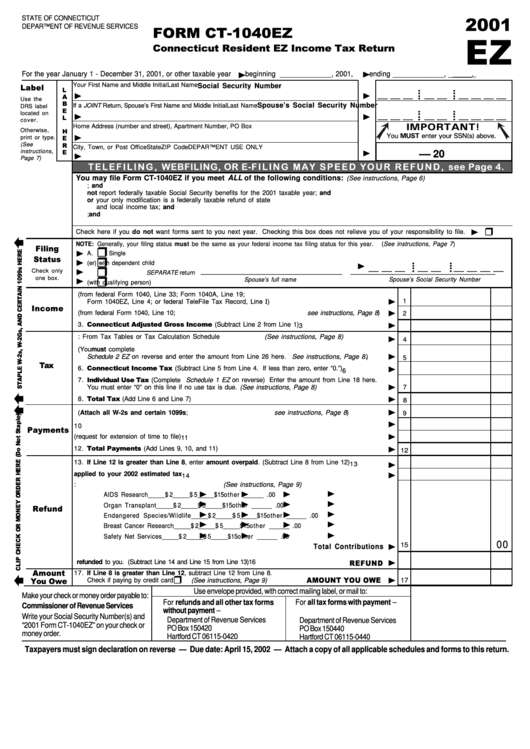

Form Ct-1040ez - Connecticut Resident Ez Income Tax Return - 2001

ADVERTISEMENT

STATE OF CONNECTICUT

DEPARTMENT OF REVENUE SERVICES

EZ

u

For the year January 1 - December 31, 2001, or other taxable year

u

beginning _____________, 2001,

ending _____________, ______.

Your First Name and Middle Initial

Last Name

Social Security Number

__ __ __

__ __

__ __ __ __

• •

• •

u

u

• •

• •

Use the

Spouse’s Social Security Number

If a JOINT Return, Spouse’s First Name and Middle Initial

Last Name

DRS label

__ __ __

__ __

__ __ __ __

• •

• •

located on

u

u

• •

• •

cover.

IMPORTANT!

Home Address (number and street), Apartment Number, PO Box

Otherwise,

You MUST enter your SSN(s) above.

u

print or type.

(See

City, Town, or Post Office

State

ZIP Code

DEPARTMENT USE ONLY

–

instructions,

u

– 20

u

Page 7)

T E L E F I L I N G , WEBFILING, O R E-F I L I N G M AY S P E E D Y O U R R E F U N D, see Page 4.

You may file Form CT-1040EZ if you meet ALL of the following conditions:

(See instructions, Page 6)

A. You were a resident of Connecticut for the entire taxable year; and

B. You did not report federally taxable Social Security benefits for the 2001 taxable year; and

C. You had no modifications to federal adjusted gross income or your only modification is a federally taxable refund of state

and local income tax; and

D. You are not claiming credit for income taxes paid to a qualifying jurisdiction; and

E. You do not have a federal alternative minimum tax liability and are not claiming an adjusted net Connecticut minimum tax credit.

H

u

Check here if you do not want forms sent to you next year. Checking this box does not relieve you of your responsibility to file.

Å

NOTE: Generally, your filing status must be the same as your federal income tax filing status for this year. ( See instructions, Page 7 )

H

u

A.

Single

H

u

__ __ __

__ __

__ __ __ __

B.

Married filing joint return or Qualifying widow(er) with dependent child

• •

• •

u

H

• •

• •

u

Check only

Married filing SEPARATE return __________________________________________

___________________________________________

C.

H

one box.

u

Spouse’s full name

Spouse’s Social Security Number

D.

Head of household (with qualifying person)

1. Federal Adjusted Gross Income (from federal Form 1040, Line 33; Form 1040A, Line 19;

u

1

I

Form 1040EZ, Line 4; or federal TeleFile Tax Record, Line

)

u

2. Refunds of state and local income taxes (from federal Form 1040, Line 10; see instructions, Page 8 )

2

u

3.

(Subtract Line 2 from Line 1)

3

4. Income Tax: From Tax Tables or Tax Calculation Schedule (See instructions, Page 8)

u

4

5. Credit for property taxes paid on your primary residence and/or motor vehicle. (You must complete

u

Schedule 2 EZ on reverse and enter the amount from Line 26 here. See instructions, Page 8. )

5

u

6.

(Subtract Line 5 from Line 4. If less than zero, enter “0.”)

6

7.

(Complete Schedule 1 EZ on reverse) Enter the amount from Line 18 here.

u

You must enter “0” on this line if no use tax is due. (See instructions, Page 8)

7

Å

u

8.

(Add Line 6 and Line 7)

8

Å

u

9. Connecticut tax withheld (Attach all W-2s and certain 1099s; see instructions, Page 8 )

9

u

10. All 2001 estimated tax payments and any overpayments applied from a prior year

10

u

11. Payments made with Form CT-1040 EXT (request for extension of time to file)

11

u

12.

(Add Lines 9, 10, and 11)

12

13. If Line 12 is greater than Line 8, enter amount overpaid. (Subtract Line 8 from Line 12)

u

13

14. Amount of Line 13 you want applied to your 2002 estimated tax

u

14

15. Amount of Line 13 you want to contribute to: (See instructions, Page 9)

u

u

u

u

AIDS Research

_____ $ 2

_____ $ 5

_____ $ 1 5

other ______ . 0 0

u

u

u

u

Organ Transplant

_____ $ 2

_____ $ 5

_____ $ 1 5

other ______ . 0 0

u

u

u

u

Endangered Species/Wildlife

_____ $ 2

_____ $ 5

_____ $ 1 5

other ______ . 0 0

u

u

u

u

Breast Cancer Research

_____ $ 2

_____ $ 5

_____ $ 1 5

other ______ . 0 0

u

u

u

u

Safety Net Services

_____ $ 2

_____ $ 5

_____ $ 1 5

other ______ . 0 0

00

15

u

Total Contributions

u

16. Amount of Line 13 you want refunded to you. (Subtract Line 14 and Line 15 from Line 13)

16

17. If Line 8 is greater than Line 12, subtract Line 12 from Line 8.

Å

H

u

(See instructions, Page 9)

17

Check if paying by credit card

Use envelope provided, with correct mailing label, or mail to:

Make your check or money order payable to:

For all tax forms with payment –

For refunds and all other tax forms

Commissioner of Revenue Services

without payment –

Write your Social Security Number(s) and

Department of Revenue Services

Department of Revenue Services

“2001 Form CT-1040EZ” on your check or

PO Box 150420

PO Box 150440

money order.

Hartford CT 06115-0420

Hartford CT 06115-0440

Taxpayers must sign declaration on reverse — Due date: April 15, 2002 — Attach a copy of all applicable schedules and forms to this return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2