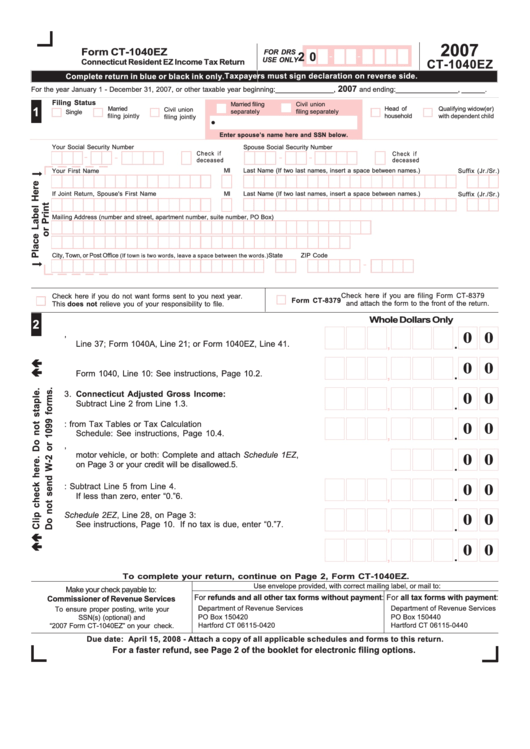

Form Ct-1040ez - Connecticut Resident Ez Income Tax Return - 2007

ADVERTISEMENT

2007

Form CT-1040EZ

FOR DRS

2 0

USE ONLY

CT-1040EZ

Connecticut Resident EZ Income Tax Return

Taxpayers must sign declaration on reverse side.

Complete return in blue or black ink only.

2007

For the year January 1 - December 31, 2007, or other taxable year beginning: _______________ ,

and ending: ________________ , ______ .

Filing Status

Married filing

Civil union

1

Married

Head of

Qualifying widow(er)

Civil union

Single

separately

filing separately

filing jointly

household

with dependent child

filing jointly

Enter spouse’s name here and SSN below.

Your Social Security Number

Spouse Social Security Number

-

Check if

Check if

-

-

-

deceased

deceased

MI

Your First Name

Last Name (If two last names, insert a space between names.)

Suffix (Jr./Sr.)

MI

If Joint Return, Spouse's First Name

Last Name (If two last names, insert a space between names.)

Suffix (Jr./Sr.)

Mailing Address (number and street, apartment number, suite number, PO Box)

City, Town, or Post Office

State

ZIP Code

(If town is two words, leave a space between the words.)

-

Check here if you are filing Form CT-8379

Check here if you do not want forms sent to you next year.

Form CT-8379

and attach the form to the front of the return.

This does not relieve you of your responsibility to file.

Whole Dollars Only

2

0 0

1. Federal adjusted gross income from federal Form 1040,

,

.

Line 37; Form 1040A, Line 21; or Form 1040EZ, Line 4

1.

2. Refunds of state and local income taxes from federal

0 0

,

.

Form 1040, Line 10: See instructions, Page 10.

2.

3. Connecticut Adjusted Gross Income:

0 0

,

.

Subtract Line 2 from Line 1.

3.

4. Income Tax: from Tax Tables or Tax Calculation

0 0

,

.

Schedule: See instructions, Page 10.

4.

5. Credit for property taxes paid on your primary residence,

motor vehicle, or both: Complete and attach Schedule 1EZ,

0 0

.

on Page 3 or your credit will be disallowed.

5.

0 0

6. Connecticut income tax: Subtract Line 5 from Line 4.

,

.

If less than zero, enter “0.”

6.

7. Individual Use Tax from Schedule 2EZ, Line 28, on Page 3:

0 0

See instructions, Page 10. If no tax is due, enter “0.”

7.

,

.

0 0

,

.

8. Add Line 6 and Line 7.

8.

To complete your return, continue on Page 2, Form CT-1040EZ.

Use envelope provided, with correct mailing label, or mail to:

Make your check payable to:

For refunds and all other tax forms without payment:

For all tax forms with payment:

Commissioner of Revenue Services

Department of Revenue Services

Department of Revenue Services

To ensure proper posting, write your

PO Box 150420

PO Box 150440

SSN(s) (optional) and

“2007 Form CT-1040EZ” on your check.

Hartford CT 06115-0420

Hartford CT 06115-0440

Due date: April 15, 2008 - Attach a copy of all applicable schedules and forms to this return.

For a faster refund, see Page 2 of the booklet for electronic filing options.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3