Form Ct-945 - Connecticut Annual Reconciliation Of Withholding For Nonpayroll Amounts - 2007

ADVERTISEMENT

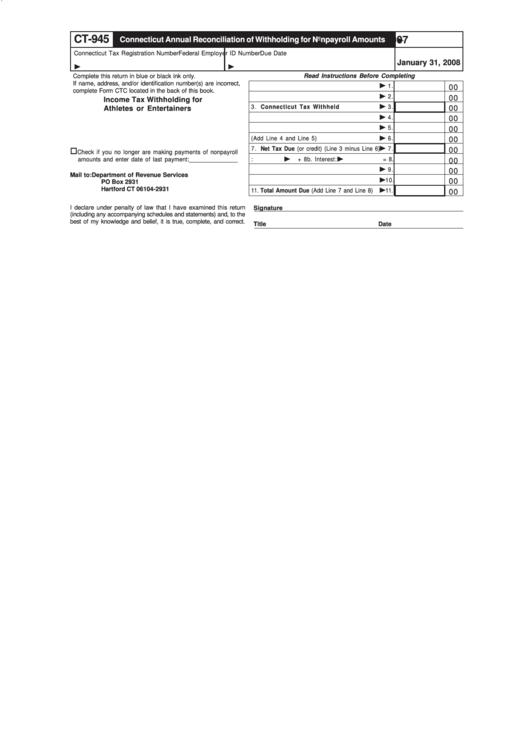

CT-945

2007

Connecticut Annual Reconciliation of Withholding for Nonpayroll Amounts

Connecticut Tax Registration Number

Federal Employer ID Number

Due Date

January 31, 2008

Complete this return in blue or black ink only.

Read Instructions Before Completing

If name, address, and/or identification number(s) are incorrect,

1 . Gross Nonpayroll Amounts

1 .

00

complete Form CTC located in the back of this book.

2 . Gross Connecticut Nonpayroll Amounts

2 .

00

Income Tax Withholding for

3 . Connecticut Tax Withheld

3 .

00

Athletes or Entertainers

4 . Credit From Prior Year

4 .

00

5 . Payments Made for This Year

5 .

00

6 . Total Payments (Add Line 4 and Line 5)

6 .

00

7 . Net Tax Due (or credit) (Line 3 minus Line 6)

7 .

00

Check if you no longer are making payments of nonpayroll

8a. Penalty:

+ 8b. Interest:

= 8.

amounts and enter date of last payment: _______________

00

9 . Amount to be Credited

9 .

00

Mail to:

Department of Revenue Services

10. Amount to be Refunded

10.

00

PO Box 2931

Hartford CT 06104-2931

11. Total Amount Due (Add Line 7 and Line 8)

11.

00

I declare under penalty of law that I have examined this return

Signature

(including any accompanying schedules and statements) and, to the

best of my knowledge and belief, it is true, complete, and correct.

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2