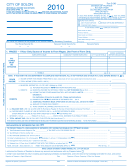

Form S-1040 - Individual Income Tax Return - City Of Solon Page 2

ADVERTISEMENT

WHEN SUBMITTING PLEASE ATTACH ALL FEDERAL SCHEDULES THAT APPLY

SCHEDULE C

PROFIT OR LOSS FROM BUSINESS OR PROFESSION

Business Name

Business Address

Net Profit or Loss

1.

2.

3.

4.

Total Schedule C

$_______________________

SCHEDULE G

INCOME FROM RENTS (Not included in Schedule C)

Type & Address of Property, City & State

Tenant’s Name

Net Income (Loss)

1.

2.

3.

4.

Total Schedule G

$_______________________

SCHEDULE H

ALL OTHER TAXABLE INCOME

PLEASE ATTACH K-1’S AND 1099’S

INTEREST AND DIVIDENDS NOT TAXABLE

Individual’s distributive share of income from partnerships, estates, trusts, director’s and other fees, farm and other

sources (See Instructions)

Received from

Federal I.D. #

For (Describe)

Amount

1.

2.

3.

4.

Total Schedule H

$_____________________

DEDUCT Loss carried forward from previous years, if any – Attached Schedule $ (

)

TOTAL

From Schedules C, G & H above

Enter on Page 1, Line 2

$

EXEMPTION: (Check appropriate box and sign on front)

I am required to file a return since I am a resident of Solon but I have no taxable income because:

Under 18 years of age for entire year (Documentation of age required) Date of Birth:

Retired or disabled, receiving only pension, Social Security, interest or dividends.

An active member of the Armed Forces of the United States for the entire year.

(This does not include civilians employed by the military or National Guard).

Other (Explain)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2