Section 83(B) Election Form

Download a blank fillable Section 83(B) Election Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Section 83(B) Election Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

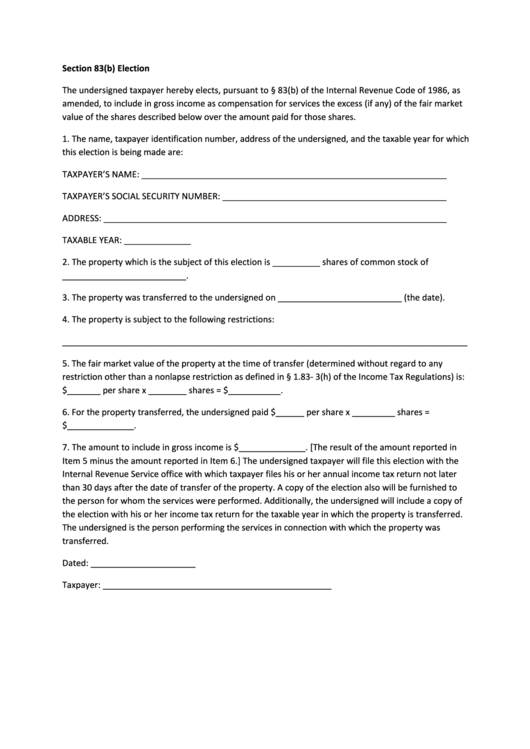

Section 83(b) Election

The undersigned taxpayer hereby elects, pursuant to § 83(b) of the Internal Revenue Code of 1986, as

amended, to include in gross income as compensation for services the excess (if any) of the fair market

value of the shares described below over the amount paid for those shares.

1. The name, taxpayer identification number, address of the undersigned, and the taxable year for which

this election is being made are:

TAXPAYER’S NAME: ________________________________________________________________

TAXPAYER’S SOCIAL SECURITY NUMBER: _______________________________________________

ADDRESS: ________________________________________________________________________

TAXABLE YEAR: ______________

2. The property which is the subject of this election is __________ shares of common stock of

__________________________.

3. The property was transferred to the undersigned on __________________________ (the date).

4. The property is subject to the following restrictions:

_____________________________________________________________________________________

5. The fair market value of the property at the time of transfer (determined without regard to any

restriction other than a nonlapse restriction as defined in § 1.83- 3(h) of the Income Tax Regulations) is:

$_______ per share x ________ shares = $___________.

6. For the property transferred, the undersigned paid $______ per share x _________ shares =

$______________.

7. The amount to include in gross income is $______________. [The result of the amount reported in

Item 5 minus the amount reported in Item 6.] The undersigned taxpayer will file this election with the

Internal Revenue Service office with which taxpayer files his or her annual income tax return not later

than 30 days after the date of transfer of the property. A copy of the election also will be furnished to

the person for whom the services were performed. Additionally, the undersigned will include a copy of

the election with his or her income tax return for the taxable year in which the property is transferred.

The undersigned is the person performing the services in connection with which the property was

transferred.

Dated: ______________________

Taxpayer: ________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1