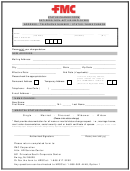

GIC EMPLOYMENT STATUS CHANGE FORM (FORM-1A) INSTRUCTIONS

Use this Form-1A for all employment status changes including retirement. If enrolling in GIC health insurance coverage

for the first time at retirement, you must also complete and return Form-RS.

For GIC retiree benefits, see the GIC Benefit Decision Guide

Leave of Absence

Employees on a leave of absence without pay are billed monthly and must remit payment to the GIC to maintain

GIC insurance coverage. In addition to this form, the GIC’s Form-11 is required for unpaid Personal Illness, Industrial

Accident and Maternity leaves. An employee can cancel some or all of their GIC coverage while on a leave of absence.

However, when the employee returns to work after a leave of absence he/she is subject to Annual Enrollment (basic life

and health insurance) and Evidence of Insurability requirements (LTD and Optional Life). Employee on FMLA or military

leave only, may enroll in GIC health insurance upon return from leave. The status change form (Form-1A) must be

received at the GIC within 60 days of the return to work.

Transfers and Terminations

Because GIC premiums are paid a month in advance, coverage terminates at the end of the following month after

you leave a state agency or GIC participating municipality (for example, if you leave June 10, your coverage will end

July 31). If you are hired by a state agency, authority, or participating municipality before the coverage end date, you

are considered a transfer and will not be subject to the 60-day waiting period. You must remain in the same health

plan. For other GIC benefits, the same rule applies. If you are hired after the coverage end date, you are subject to the

60-day new hire waiting period. If an employee is terminating state service, he/she may continue GIC health coverage

and must indicate the option elected. Please put the termination reason (e.g., resigned or laid off).

Retirement

When you retire, the GIC will bill you monthly for your GIC premiums until the premium can be deducted from your

pension (generally three months). You must pay your GIC premiums to maintain coverage.

If you and/or your covered spouse are age 65 or over, and eligible for Medicare Part A for free, you (and your covered

spouse, if applicable) must enroll in Medicare Parts A and B to continue coverage with the GIC. If one of you (or other

family members) is under age 65, the Non Medicare member(s) will be covered under a Non Medicare plan until he/

she becomes eligible for Medicare coverage. The following are your Medicare/Non Medicare health plan combination

choices:

Non-Medicare Plan

Medicare Plan

Fallon Health Direct Care

Fallon Senior Plan

Fallon Health Select Care

Fallon Senior Plan

Harvard Pilgrim Independence Plan

Harvard Pilgrim Medicare Enhance

Harvard Pilgrim Primary Choice Plan

Harvard Pilgrim Medicare Enhance

Health New England

Health New England MedPlus

Tufts Health Plan Navigator

Tufts Health Plan Medicare Complement

Tufts Health Plan Navigator

Tufts Health Plan Medicare Preferred

Tufts Health Plan Spirit

Tufts Health Plan Medicare Complement

Tufts Health Plan Spirit

Tufts Health Plan Medicare Preferred

UniCare State Indemnity Plan/Basic

UniCare State Indemnity Plan/Medicare Extension (OME)

UniCare State Indemnity Plan/Community Choice

UniCare State Indemnity Plan/Medicare Extension (OME)

UniCare State Indemnity Plan/PLUS

UniCare State Indemnity Plan/Medicare Extension (OME)

Employees who are retiring should review the amount of your optional life insurance coverage and its cost to

determine whether it will make economic sense for you to keep it or reduce your amount of coverage. If you do not

change your optional life insurance coverage amount, you will be responsible for the new higher monthly premiums.

(See for rate details.)

If you reduce your coverage to a fixed amount, the amount must be equal to or less than one times the amount of your

salary at retirement. Another option is to reduce the multiple times your salary at retirement to a lower multiple. For

example, if you currently have 6 times salary, you can only reduce to 5, 4, 3, 2, or 1 times your salary.

GIC Retiree Dental: The GIC Retiree Dental form is on the GIC‘s website

Form and Document Submission

Active Employees and Employees Who Are Retiring: Return completed form and documentation to your GIC Coordinator.

Retirees Changing Optional Life Insurance Election: Return completed form to the Group Insurance Commission,

P.O. Box 8747, Boston, MA 02114.

(See over for Form-1A)

3/15

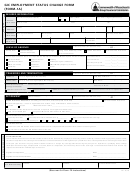

1

1 2

2