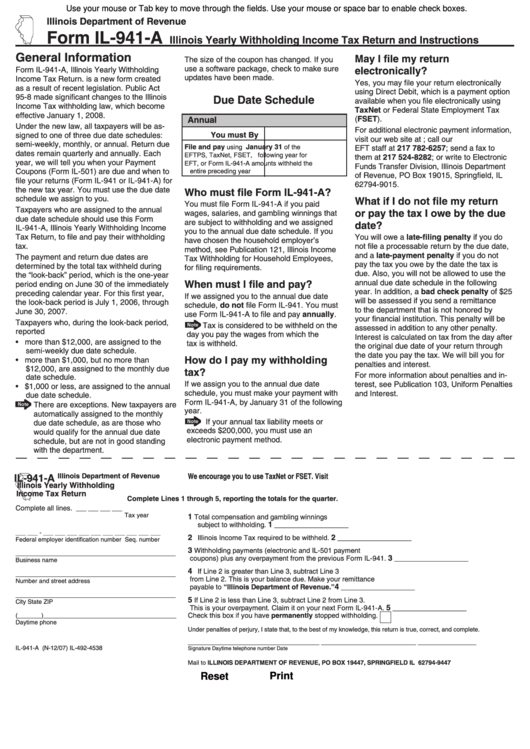

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

Form IL-941-A

Illinois Yearly Withholding Income Tax Return and Instructions

General Information

May I file my return

The size of the coupon has changed. If you

use a software package, check to make sure

electronically?

Form IL-941-A, Illinois Yearly Withholding

updates have been made.

Income Tax Return. is a new form created

Yes, you may file your return electronically

as a result of recent legislation. Public Act

using Direct Debit, which is a payment option

95-8 made significant changes to the Illinois

Due Date Schedule

available when you file electronically using

Income Tax withholding law, which become

TaxNet or Federal State Employment Tax

effective January 1, 2008.

Annual

(FSET).

Under the new law, all taxpayers will be as-

For additional electronic payment information,

You must

By

signed to one of three due date schedules:

visit our web site at tax.illinois.gov; call our

semi-weekly, monthly, or annual. Return due

File and pay

January 31

using

of the

EFT staff at 217 782-6257; send a fax to

dates remain quarterly and annually. Each

EFTPS, TaxNet, FSET,

following year for

them at 217 524-8282; or write to Electronic

year, we will tell you when your Payment

EFT, or Form IL-941-A

amounts withheld the

Funds Transfer Division, Illinois Department

Coupons (Form IL-501) are due and when to

entire preceding year

of Revenue, PO Box 19015, Springfield, IL

file your returns (Form IL-941 or IL-941-A) for

62794-9015.

the new tax year. You must use the due date

Who must file Form IL-941-A?

schedule we assign to you.

What if I do not file my return

You must file Form IL-941-A if you paid

Taxpayers who are assigned to the annual

or pay the tax I owe by the due

wages, salaries, and gambling winnings that

due date schedule should use this Form

are subject to withholding and we assigned

date?

IL-941-A, Illinois Yearly Withholding Income

you to the annual due date schedule. If you

Tax Return, to file and pay their withholding

You will owe a late-filing penalty if you do

have chosen the household employer’s

tax.

not file a processable return by the due date,

method, see Publication 121, Illinois Income

and a late-payment penalty if you do not

The payment and return due dates are

Tax Withholding for Household Employees,

pay the tax you owe by the date the tax is

determined by the total tax withheld during

for filing requirements.

due. Also, you will not be allowed to use the

the “look-back” period, which is the one-year

When must I file and pay?

annual due date schedule in the following

period ending on June 30 of the immediately

year. In addition, a bad check penalty of $25

preceding calendar year. For this first year,

If we assigned you to the annual due date

will be assessed if you send a remittance

the look-back period is July 1, 2006, through

schedule, do not file Form IL-941. You must

to the department that is not honored by

June 30, 2007.

use Form IL-941-A to file and pay annually.

your financial institution. This penalty will be

Taxpayers who, during the look-back period,

Tax is considered to be withheld on the

assessed in addition to any other penalty.

reported

day you pay the wages from which the

Interest is calculated on tax from the day after

• more than $12,000, are assigned to the

tax is withheld.

the original due date of your return through

semi-weekly due date schedule.

the date you pay the tax. We will bill you for

How do I pay my withholding

• more than $1,000, but no more than

penalties and interest.

$12,000, are assigned to the monthly due

tax?

For more information about penalties and in-

date schedule.

If we assign you to the annual due date

terest, see Publication 103, Uniform Penalties

• $1,000 or less, are assigned to the annual

schedule, you must make your payment with

and Interest.

due date schedule.

Form IL-941-A, by January 31 of the following

There are exceptions. New taxpayers are

year.

automatically assigned to the monthly

If your annual tax liability meets or

due date schedule, as are those who

exceeds $200,000, you must use an

would qualify for the annual due date

electronic payment method.

schedule, but are not in good standing

with the department.

Illinois Department of Revenue

We encourage you to use TaxNet or FSET. Visit tax.illinois.gov

IL-941-A

Illinois Yearly Withholding

Income Tax Return

Complete Lines 1 through 5, reporting the totals for the quarter.

Complete all lines.

___ ___ ___ ___

Tax

year

1

Total compensation and gambling winnings

1

subject to withholding.

___________________

___ ___ - ___ ___ ___ ___ ___ ___ ___

___ ___ ___

2

2

Illinois Income Tax required to be withheld.

___________________

Federal employer identification number

Seq. number

3

Withholding payments (electronic and IL-501 payment

_______________________________________________

3

coupons) plus any overpayment from the previous Form IL-941.

___________________

Business name

4

If Line 2 is greater than Line 3, subtract Line 3

_______________________________________________

from Line 2. This is your balance due. Make your remittance

Number and street address

4

payable to “Illinois Department of Revenue.”

___________________

_______________________________________________

5

If Line 2 is less than Line 3, subtract Line 2 from Line 3.

City

State

ZIP

5

This is your overpayment. Claim it on your next Form IL-941-A.

___________________

Check this box if you have permanently stopped withholding.

(_______)_______________________________________

Daytime phone

Under penalties of perjury, I state that, to the best of my knowledge, this return is true, correct, and complete.

____________________________________ __________________________ ________________

IL-941-A (N-12/07) IL-492-4538

Signature

Daytime telephone number

Date

Mail to ILLINOIS DEPARTMENT OF REVENUE, PO BOX 19447, SPRINGFIELD IL 62794-9447

Reset

Print

1

1 2

2