Form Ct-656a - Offer Of Compromise

ADVERTISEMENT

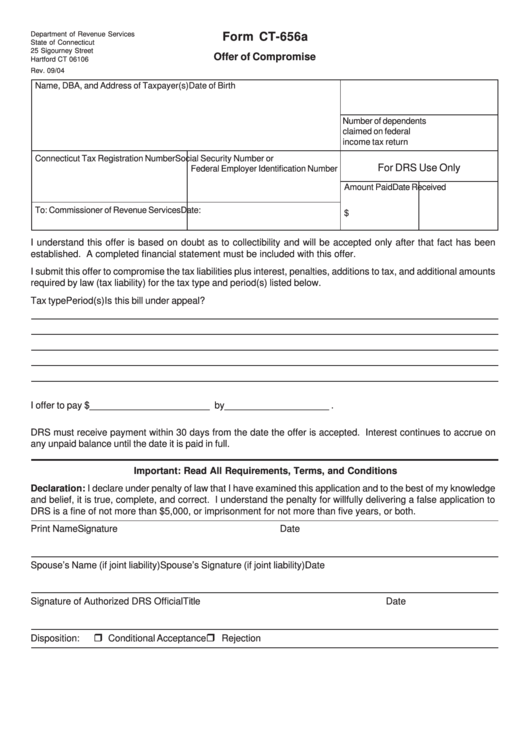

Department of Revenue Services

Form CT-656a

State of Connecticut

25 Sigourney Street

Offer of Compromise

Hartford CT 06106

Rev. 09/04

Name, DBA, and Address of Taxpayer(s)

Date of Birth

Number of dependents

claimed on federal

income tax return

Connecticut Tax Registration Number

Social Security Number or

For DRS Use Only

Federal Employer Identification Number

Amount Paid

Date Received

To: Commissioner of Revenue Services

Date:

$

I understand this offer is based on doubt as to collectibility and will be accepted only after that fact has been

established. A completed financial statement must be included with this offer.

I submit this offer to compromise the tax liabilities plus interest, penalties, additions to tax, and additional amounts

required by law (tax liability) for the tax type and period(s) listed below.

Tax type

Period(s)

Is this bill under appeal?

I offer to pay $ _______________________ by ____________________ .

DRS must receive payment within 30 days from the date the offer is accepted. Interest continues to accrue on

any unpaid balance until the date it is paid in full.

Important: Read All Requirements, Terms, and Conditions

Declaration: I declare under penalty of law that I have examined this application and to the best of my knowledge

and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false application to

DRS is a fine of not more than $5,000, or imprisonment for not more than five years, or both.

Print Name

Signature

Date

Spouse’s Name (if joint liability)

Spouse’s Signature (if joint liability)

Date

Signature of Authorized DRS Official

Title

Date

Disposition:

Conditional Acceptance

Rejection

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2