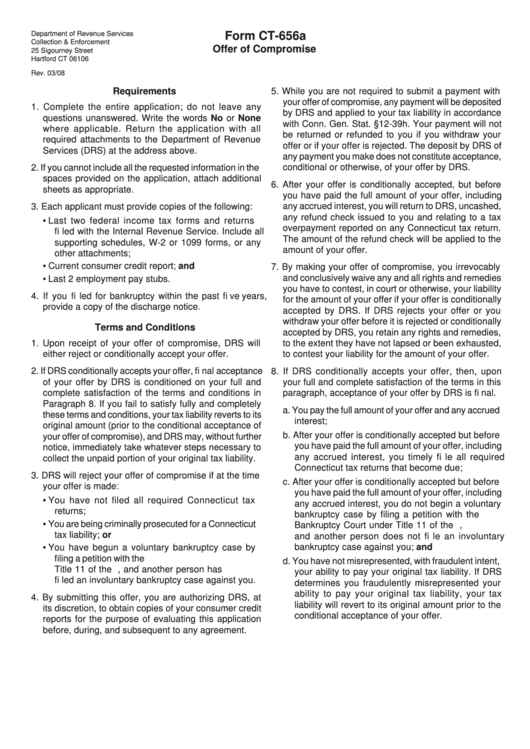

Department of Revenue Services

Form CT-656a

Collection & Enforcement

Offer of Compromise

25 Sigourney Street

Hartford CT 06106

Rev. 03/08

Requirements

5. While you are not required to submit a payment with

your offer of compromise, any payment will be deposited

1. Complete the entire application; do not leave any

by DRS and applied to your tax liability in accordance

questions unanswered. Write the words No or None

with Conn. Gen. Stat. §12-39h. Your payment will not

where applicable. Return the application with all

be returned or refunded to you if you withdraw your

required attachments to the Department of Revenue

offer or if your offer is rejected. The deposit by DRS of

Services (DRS) at the address above.

any payment you make does not constitute acceptance,

conditional or otherwise, of your offer by DRS.

2. If you cannot include all the requested information in the

spaces provided on the application, attach additional

6. After your offer is conditionally accepted, but before

sheets as appropriate.

you have paid the full amount of your offer, including

any accrued interest, you will return to DRS, uncashed,

3. Each applicant must provide copies of the following:

any refund check issued to you and relating to a tax

• Last two federal income tax forms and returns

overpayment reported on any Connecticut tax return.

fi led with the Internal Revenue Service. Include all

The amount of the refund check will be applied to the

supporting schedules, W-2 or 1099 forms, or any

amount of your offer.

other attachments;

• Current consumer credit report; and

7. By making your offer of compromise, you irrevocably

and conclusively waive any and all rights and remedies

• Last 2 employment pay stubs.

you have to contest, in court or otherwise, your liability

4. If you fi led for bankruptcy within the past fi ve years,

for the amount of your offer if your offer is conditionally

provide a copy of the discharge notice.

accepted by DRS. If DRS rejects your offer or you

withdraw your offer before it is rejected or conditionally

Terms and Conditions

accepted by DRS, you retain any rights and remedies,

1. Upon receipt of your offer of compromise, DRS will

to the extent they have not lapsed or been exhausted,

either reject or conditionally accept your offer.

to contest your liability for the amount of your offer.

2. If DRS conditionally accepts your offer, fi nal acceptance

8. If DRS conditionally accepts your offer, then, upon

of your offer by DRS is conditioned on your full and

your full and complete satisfaction of the terms in this

complete satisfaction of the terms and conditions in

paragraph, acceptance of your offer by DRS is fi nal.

Paragraph 8. If you fail to satisfy fully and completely

a. You pay the full amount of your offer and any accrued

these terms and conditions, your tax liability reverts to its

interest;

original amount (prior to the conditional acceptance of

b. After your offer is conditionally accepted but before

your offer of compromise), and DRS may, without further

you have paid the full amount of your offer, including

notice, immediately take whatever steps necessary to

any accrued interest, you timely fi le all required

collect the unpaid portion of your original tax liability.

Connecticut tax returns that become due;

3. DRS will reject your offer of compromise if at the time

c. After your offer is conditionally accepted but before

your offer is made:

you have paid the full amount of your offer, including

• You have not filed all required Connecticut tax

any accrued interest, you do not begin a voluntary

returns;

bankruptcy case by fi ling a petition with the U.S.

• You are being criminally prosecuted for a Connecticut

Bankruptcy Court under Title 11 of the U.S. Code,

tax liability; or

and another person does not fi le an involuntary

bankruptcy case against you; and

• You have begun a voluntary bankruptcy case by

fi ling a petition with the U.S. Bankruptcy Court under

d. You have not misrepresented, with fraudulent intent,

Title 11 of the U.S. Code, and another person has

your ability to pay your original tax liability. If DRS

fi led an involuntary bankruptcy case against you.

determines you fraudulently misrepresented your

ability to pay your original tax liability, your tax

4. By submitting this offer, you are authorizing DRS, at

liability will revert to its original amount prior to the

its discretion, to obtain copies of your consumer credit

conditional acceptance of your offer.

reports for the purpose of evaluating this application

before, during, and subsequent to any agreement.

1

1 2

2 3

3