Form Ct-706 Nt Draft - Connecticut Estate Tax Return (For Nontaxable Estates) Page 2

ADVERTISEMENT

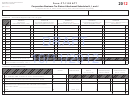

Section 3

Property and Proceeds Reported for Connecticut Estate Tax Purposes

Part 1 - Solely-Owned Property

A

B

C

D

E

Item

Description of All Property and Two-Letter Abbreviation of State Where Located

Decedent’s

Fair Market Value

Amount of

No.

% of

at Date of Death

Column D

If real property, list the complete address. Include all property, real or personal, tangible or intangible,

Ownership

Passing to Spouse

wherever located. If necessary, attach additional sheet(s) and continue with Item 1F.

State

1.

1A

100%

2.

1B

100%

3.

1C

100%

4.

1D

100%

5.

1E

100%

6.

Total: Add all amounts for Column D and Column E.

Part 2 - Jointly-Owned Property and Property Passing Other Than by Will or Laws of Intestacy

A

B

C

D

E

F

Item

Description of All Property and Two-Letter Abbreviation of State Where Located

Fair Market Value

Percentage

Includible Value

Amount of

No.

at Date of Death

Includible

Attributed to This

Column E

If real property, list the complete address. Include all property, real or

Estate

Passing to Spouse

personal, tangible or intangible, wherever located. If necessary, attach

(Col. C x Col. D)

additional sheet(s) and continue with Item 2F.

State

7.

2A

8.

2B

9.

2C

10. 2D

11. 2E

12. Total: Add all amounts for Column E and Column F.

Part 3 - Life Insurance Proceeds on the Life of the Decedent

B

A

C

D

Life Insurance Value

Description of Life Insurance

Amount of

Item

Report the entire

Column C

Attach copy of federal Form 712 for each policy. If necessary, attach additional sheet(s) and continue with

No.

proceeds from

Passing to Spouse

each policy.

Item 3D.

13. 3A

14. 3B

15. 3C

16. Total: Add all amounts for Column C and Column D.

Form CT-706 NT (Rev. 06/17)

Page 2 of 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5