Form Ct-706 Nt Draft - Connecticut Estate Tax Return (For Nontaxable Estates) Page 4

ADVERTISEMENT

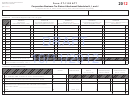

Schedule A (NT) Computation of Current Year Connecticut Taxable Gifts

A

B

C

D

E

F

G

Net Transfer

Gifts Subject to Gift Tax

Adjusted

Date

Value at Date of Gift

Split Gifts Only

Item

•

Basis of Gift

of Gift

Donee’s name, address, SSN, relationship to

Enter the fair market

Subtract

No.

For split gifts, enter

decedent, if any;

value at the date

Column F from

1/2 of Column E.

•

Gift description: If gift was made by means of a

the gift was made.

Column E.

trust, enter trust’s identifying number. If gift was

securities, enter CUSIP number(s), if available.

•

Do not list Connecticut taxable gifts that are

includable in the decedent’s gross estate.

1

Gifts Made by Spouse - Complete only if decedent split gifts with his or her spouse and the spouse also made gifts.

1

1. Total gifts: Add the value of all gifts listed in Column G and enter here. ............................... 1.

00

2. Total annual exclusion for present interest gifts listed on Schedule A: See instructions. .......

2.

00

3. Subtract Line 2 from Line 1. .................................................................................................. 3.

00

Deductions

4. Gifts to spouse for which a marital

deduction is claimed: Enter item No(s).

from Schedule A ________________________ . 4.

00

5. Exclusions attributable to gifts on Line 4 .............

5.

00

6. Marital deduction: Subtract Line 5 from Line 4. . .

6.

00

7. Charitable deductions less exclusions: Enter

item numbers from Schedule A _____________ . 7.

00

8. Total deductions: Add Line 6 and Line 7. .............................................................................. 8.

00

9. Connecticut current year taxable gifts:

Subtract Line 8 from Line 3. Enter here and on Section 2, Line 4. ....................................... 9.

00

10. Did the decedent consent for federal gift tax purposes to have gifts made during the calendar year by the decedent, the decedent’s

spouse, or both, to third parties considered as made one-half by each?

Yes

No

If Yes, print spouse’s name and SSN below.

Name

SSN

__________________________________________________________

__________________________________________________

Yes

No

11. Is the decedent’s spouse a U.S. citizen? ..................................................................................................................

If No, did the decedent transfer any property to his or her spouse during the calendar year? .................................

12.

Check the box if the value of any item reported on Schedule A includes a discount for lack of marketability, a minority interest,

a fractional interest in real estate, blockage, market absorption, or any other discount. Attach an explanation giving the basis for

the claimed discounts and showing the amount of the discounts taken.

Terminable Interest Marital Deduction as Reported for Federal Gift Tax Purposes

The decedent is bound by the election made for federal gift tax purposes. Check the box if the decedent elected for federal

gift tax purposes:

To include gifts of qualified terminable interest property as gifts to his or her spouse for which a marital deduction

13.

was claimed. Enter the item numbers from Column A above of the gifts for which the decedent made this election under

IRC §2523(f).

______________________________________

14.

Not to treat as qualifi ed terminable interest property any joint and survivor annuity where only the decedent and his or her spouse

have the right to receive payments before the last to die. Enter the item numbers from Column A above for the annuity(ies) for

which the decedent made this election under IRC §2523(f)(6).

________________________________________________________

Continue with Schedule B (NT) on Page 5.

Form CT-706 NT (Rev. 06/17)

Page 4 of 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5