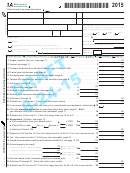

Form 1 Draft - Wisconsin Income Tax - 2013 Page 2

ADVERTISEMENT

Name

SSN

2013

2 of 4

Form 1

Page

NO COMMAS; NO CENTS

.00

14 Wisconsin income from line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

.00

15 Standard deduction . See table on page 45, OR

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

If someone else can claim you (or your spouse) as a dependent, see page 22 and check here

.00

16 Subtract line 15 from line 14. If line 15 is larger than line 14, fill in 0 . . . . . . . . . . . . . . . . . . . . . 16

17 Exemptions (Caution: See page 22)

.00

a Fill in exemptions from your federal return

x $700 . . 17a

.00

b Check if 65 or older

You +

Spouse =

x $250 . . 17b

.00

c Add lines 17a and 17b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17c

.00

18 Subtract line 17c from line 16. If line 17c is larger than line 16, fill in 0. This is taxable income . . 18

.00

19 Tax (see table on page 38) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

.00

20 Itemized deduction credit . Enclose Schedule 1, page 4 . . . . . . . . . . . . . . . 20

.00

21 Armed forces member credit

. . . 21

(must be stationed outside U .S . See page 23)

22 School property tax credit

}

.00

a Rent paid in 2013–heat included

Find credit from

.00

22a

table page 24 . . .

.00

Rent paid in 2013–heat not included

Find credit from

.00

b Property taxes paid on home in 2013

.00

22b

table page 25 . . .

.00

23 Historic rehabilitation credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

}

If line 14 is less than $10,000

24 Working families tax credit

.00

. . . 24

($19,000 if married filing joint),

see page 25

.00

25 Certain nonrefundable credits from line 15 of Schedule CR . . . . . . . . . . . . 25

.00

26 Add credits on lines 20 through 25 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

.00

27 Subtract line 26 from line 19. If line 26 is larger than line 19, fill in 0 . . . . . . . . . . . . . . . . . . . . . 27

.00

28 Alternative minimum tax . Enclose Schedule MT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

.00

29 Add lines 27 and 28 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

30 Married couple credit .

.00

Enclose Schedule 2, page 4 . . . . . . . . . . . . 30

.00

31 Other credits from Schedule CR, line 28 . . . 31

32 Net income tax paid to another state .

.00

Enclose Schedule OS . . . . . . . . . .

32

.00

33 Add lines 30, 31, and 32 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

.00

34 Subtract line 33 from line 29. If line 33 is larger than line 29, fill in 0. This is your net tax . . . . . . 34

.00

35 Sales and use tax due on Internet, mail order, or other out‑of‑state purchases (see page 28) 35

If you certify that no sales or use tax is due, check here . . . . . . . . . . . . . . . . . . . . . . . . . .

36 Donations (decreases refund or increases amount owed)

a Endangered resources

.00

f Firefighters memorial . . . . .

.00

b Packers football stadium

.00

g Military family relief . . . . . . .

.00

c Cancer research . . . . .

.00

h Second Harvest/Feeding Amer .

.00

.00

.00

d Veterans trust fund . . .

i Red Cross WI Disaster Relief

.00

.00

e Multiple sclerosis . . . .

j Special Olympics . . . . . . . .

.00

36k

Total (add lines a through j) . . . .

37 Penalties on IRAs, retirement plans, MSAs, etc .

. .

x .33 = 37

.00

.00

(see page 29)

38 Credit repayments and other penalties (see page 29) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38

.00

39 Add lines 34, 35, 36k, 37 and 38 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39

.00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4