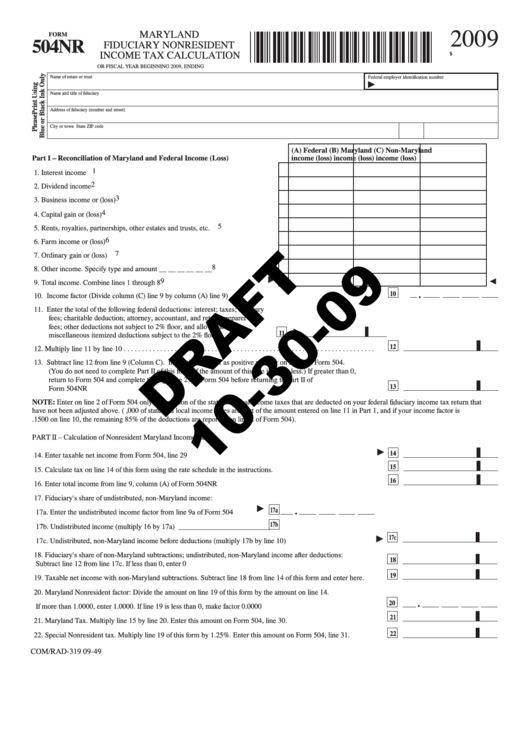

2009

MARYLAND

504NR

FORM

FIDUCIARY NONRESIDENT

INCOME TAX CALCULATION

$

09504N049

OR FISCAL YEAR BEGINNING

2009, ENDING

Name of estate or trust

Federal employer identification number

Name and title of fiduciary

Address of fiduciary (number and street)

City or town

State

ZIP code

(A) Federal

(B) Maryland

(C) Non-Maryland

Part I – Reconciliation of Maryland and Federal Income (Loss)

income (loss)

income (loss)

income (loss)

1

1. Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2. Dividend income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3. Business income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4. Capital gain or (loss). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

5. Rents, royalties, partnerships, other estates and trusts, etc. . . . . . . . . . . . . . .

6

6. Farm income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

7. Ordinary gain or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

8. Other income. Specify type and amount __ __ __ __ __ __. . . . . . . . . . . . . .

9

9. Total income. Combine lines 1 through 8. . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

10

10. Income factor (Divide column (C) line 9 by column (A) line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11. Enter the total of the following federal deductions: interest; taxes; fiduciary

fees; charitable deduction; attorney, accountant, and return preparer

fees; other deductions not subject to 2% floor, and allowable

11

miscellaneous itemized deductions subject to the 2% floor . . . . . . . . . . . . . .

12

12. Multiply line 11 by line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13. Subtract line 12 from line 9 (Column C). If less than 0 enter as positive number on line 3 of Form 504.

(You do not need to complete Part II of this form, if the amount of this line is -0- or less.) If greater than 0,

return to Form 504 and complete through line 29 of Form 504 before returning to Part II of

13

Form 504NR . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

NOTE: Enter on line 2 of Form 504 only that portion of the state and local income taxes that are deducted on your federal fiduciary income tax return that

have not been adjusted above. (e.g. if 10,000 of state and local income taxes are part of the amount entered on line 11 in Part 1, and if your income factor is

.1500 on line 10, the remaining 85% of the deductions are reported on line 2 of Form 504).

PART II – Calculation of Nonresident Maryland Income Tax

14

14. Enter taxable net income from Form 504, line 29 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

15. Calculate tax on line 14 of this form using the rate schedule in the instructions. . . . . . . . . . . . . . . . . . . . . . . . . .

16

16. Enter total income from line 9, column (A) of Form 504NR . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17. Fiduciary's share of undistributed, non-Maryland income:

.

17a

17a. Enter the undistributed income factor from line 9a of Form 504

17b

17b. Undistributed income (multiply 16 by 17a)

_________________________

17c

17c. Undistributed, non-Maryland income before deductions (multiply 17b by line 10) . . . . . . . . . . . . . . . . . . .

18. Fiduciary's share of non-Maryland subtractions; undistributed, non-Maryland income after deductions:

18

Subtract line 12 from line 17c. If less than 0, enter 0 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

19. Taxable net income with non-Maryland subtractions. Subtract line 18 from line 14 of this form and enter here.

20. Maryland Nonresident factor: Divide the amount on line 19 of this form by the amount on line 14.

.

20

If more than 1.0000, enter 1.0000. If line 19 is less than 0, make factor 0.0000 . . . . . . . . . . . . . . . . . . . . . . . . . .

21

21. Maryland Tax. Multiply line 15 by line 20. Enter this amount on Form 504, line 30.. . . . . . . . . . . . . . . . . . . . . .

22

22. Special Nonresident tax. Multiply line 19 of this form by 1.25%. Enter this amount on Form 504, line 31. . . . .

COM/RAD-319

09-49

1

1