Form Ins 4 - Insurance Premium Tax Annual/reconciliation Return - 2002

ADVERTISEMENT

*023000000*

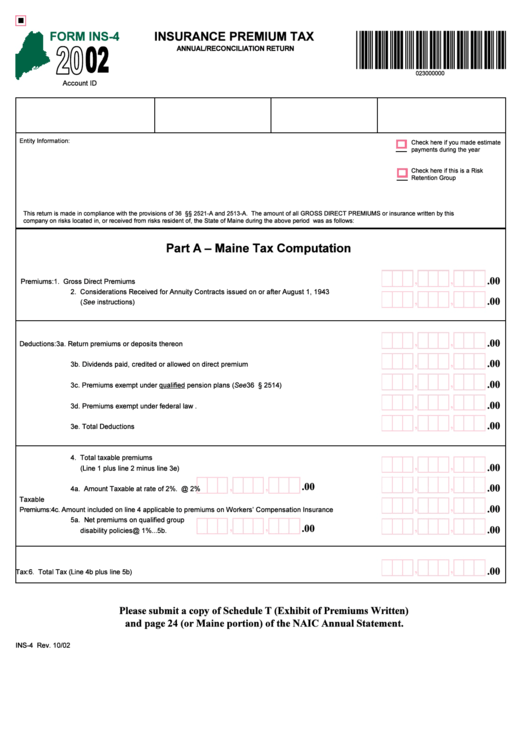

FORM INS-4

INSURANCE PREMIUM TAX

ANNUAL/RECONCILIATION RETURN

023000000

Entity Information:

Check here if you made estimate

payments during the year

Check here if this is a Risk

Retention Group

This return is made in compliance with the provisions of 36 M.R.S.A. §§ 2521-A and 2513-A. The amount of all GROSS DIRECT PREMIUMS or insurance written by this

company on risks located in, or received from risks resident of, the State of Maine during the above period was as follows:

Part A – Maine Tax Computation

,

,

.00

,

,

.00

See

,

,

.00

,

,

.00

,

,

.00

See

,

,

.00

,

,

.00

,

,

.00

.00

,

,

,

,

.00

,

,

.00

,

,

,

,

.00

.00

,

,

.00

Please submit a copy of Schedule T (Exhibit of Premiums Written)

and page 24 (or Maine portion) of the NAIC Annual Statement.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2