Form Ins-4 - Insurance Premiums Tax Return - 2005

ADVERTISEMENT

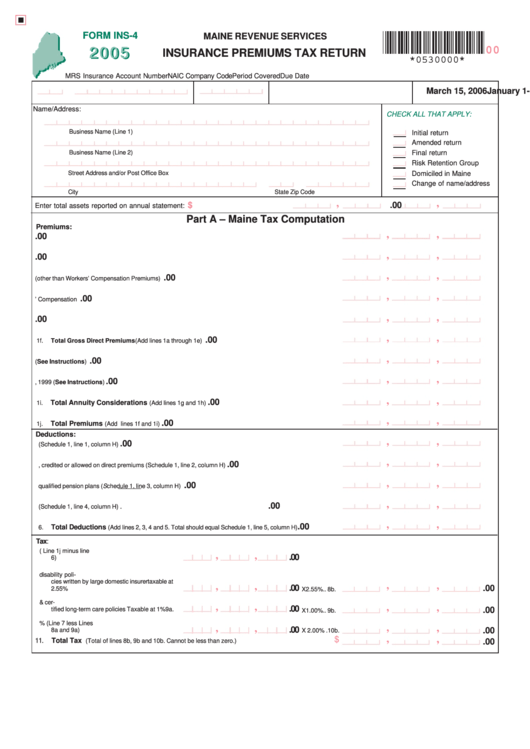

FORM INS-4

MAINE REVENUE SERVICES

2005

2005

00

INSURANCE PREMIUMS TAX RETURN

*0530000*

MRS Insurance Account Number

NAIC Company Code

Period Covered

Due Date

January 1- December 31, 2005

March 15, 2006

Name/Address:

CHECK ALL THAT APPLY:

Business Name (Line 1)

Initial return

Amended return

Business Name (Line 2)

Final return

Risk Retention Group

Street Address and/or Post Office Box

Domiciled in Maine

Change of name/address

City

State

Zip Code

,

,

,

$

.00

Enter total assets reported on annual statement: .................................................

Part A – Maine Tax Computation

Premiums:

,

,

.00

1a.

Accident and Health Premiums ................................................................................................................... 1a.

,

,

.00

1b.

Life Premiums .............................................................................................................................................. 1b.

,

,

.00

1c.

Property and Casualty Premiums (other than Workers’ Compensation Premiums) ..................................... 1c.

,

,

.00

1d.

Workers’ Compensation Premiums ............................................................................................................. 1d.

,

,

.00

1e.

Title insurance premiums ............................................................................................................................. 1e.

,

,

.00

1f.

Total Gross Direct Premiums (Add lines 1a through 1e) ........................................................................... 1f.

,

,

.00

1g.

Annuity Considerations received this tax year (See Instructions) ............................................................... 1g.

,

,

.00

1h.

Annuity Considerations received prior to January 1, 1999 (See Instructions) ............................................ 1h.

,

,

.00

Total Annuity Considerations

1i.

(Add lines 1g and 1h) ......................................................................... 1i.

,

,

.00

Total Premiums

1j.

(Add lines 1f and 1i) .................................................................................................... 1j.

Deductions:

,

,

.00

2.

Direct return premiums or deposits thereon (Schedule 1, line 1, column H) ................................................ 2.

,

,

.00

3.

Dividends paid, credited or allowed on direct premiums (Schedule 1, line 2, column H) ............................. 3.

,

,

.00

4.

Premiums exempt under qualified pension plans (Schedule 1, line 3, column H) ........................................ 4.

,

,

.00

.

5.

Other Deductions (Schedule 1, line 4, column H) ........................................................................................ 5

,

,

.00

Total Deductions

6.

(Add lines 2, 3, 4 and 5. Total should equal Schedule 1, line 5, column H) ................... 6.

Tax :

7.

Total net taxable premiums ( Line 1j minus line

,

,

.00

6) ................................................................. 7.

8.

Net premiums on qualified group disability poli-

cies written by large domestic insurer taxable at

,

,

,

,

.00

.00

2.55% ........................................................ 8a.

X 2.55%.. 8b.

9.

Net premiums on qualified group disability & cer-

,

,

,

,

.00

.00

tified long-term care policies Taxable at 1% 9a.

X 1.00%.. 9b.

10. Net premiums taxable at 2% (Line 7 less Lines

,

,

,

,

.00

.00

8a and 9a) ............................................... 10a.

X 2.00% .10b.

,

,

$

11.

Total Tax

(Total of lines 8b, 9b and 10b. Cannot be less than zero.) ................................................. 11.

.00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4