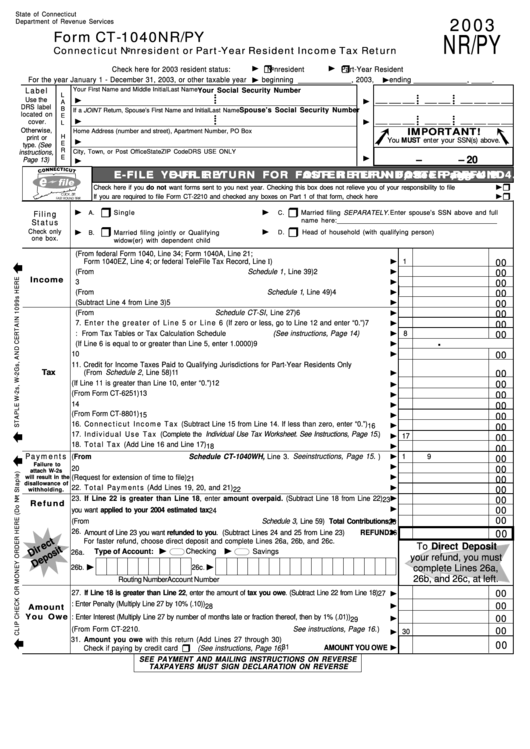

Form Ct-1040nr/py - Nonresident Or Part-Year Resident Income Tax Return - 2003

ADVERTISEMENT

State of Connecticut

2003

Department of Revenue Services

NR/PY

Form CT-1040NR/PY

Connecticut Nonresident or Part-Year Resident Income Tax Return

!

!

!

!

Check here for 2003 resident status:

Nonresident

Part-Year Resident

!

!

For the year January 1 - December 31, 2003, or other taxable year

beginning _____________, 2003,

ending _____________, _____.

Label

Your First Name and Middle Initial

Last Name

Your Social Security Number

L

• •

• •

• •

__ __ __ __ __ __ __ __ __

!

Use the

A

!

• •

• •

• •

B

DRS label

Spouse’s Social Security Number

If a JOINT Return, Spouse’s First Name and Initial

Last Name

E

located on

• •

• •

• •

__ __ __ __ __ __ __ __ __

L

!

!

cover.

• •

• •

• •

IMPORTANT!

Otherwise,

Home Address (number and street), Apartment Number, PO Box

H

print or

You MUST enter your SSN(s) above.

!

E

type. (See

R

City, Town, or Post Office

State

ZIP Code

DRS USE ONLY

instructions,

E

!

–

– 20

Page 13)

!

E-FILE Y

E-FILE Y

OUR RETURN FOR F

OUR RETURN FOR F

ASTER REFUND

ASTER REFUND

, see P

, see Pa a a a a g g g g g e 4.

, see P

e 4.

e 4.

E-FILE Y

E-FILE Y

E-FILE YOUR RETURN FOR F

OUR RETURN FOR F

OUR RETURN FOR FASTER REFUND

ASTER REFUND

ASTER REFUND, see P

, see P

e 4.

e 4.

!

!

Check here if you do not want forms sent to you next year. Checking this box does not relieve you of your responsibility to file .....................

!

!

If you are required to file Form CT-2210 and checked any boxes on Part 1 of that form, check here ...............................................................

!

!

Filing

!

!

Married filing SEPARATELY. Enter spouse’s SSN above and full

A.

Single

C.

Status

name here: ____________________________________________

!

!

!

Check only

!

D.

Head of household (with qualifying person)

B.

Married filing jointly or Qualifying

one box.

widow(er) with dependent child

1. Federal Adjusted Gross Income (From federal Form 1040, Line 34; Form 1040A, Line 21;

!

Form 1040EZ, Line 4; or federal TeleFile Tax Record, Line I)

1

00

"

!

2. Additions to Federal Adjusted Gross Income (From Schedule 1 , Line 39)

2

00

Income

!

3. Add Line 1 and Line 2

3

00

4. Subtractions from Federal Adjusted Gross Income (From Schedule 1 , Line 49)

!

4

00

!

5. Connecticut Adjusted Gross Income (Subtract Line 4 from Line 3)

5

00

!

6. Income from Connecticut sources (From Schedule CT-SI , Line 27)

6

00

7. Enter the greater of Line 5 or Line 6 (If zero or less, go to Line 12 and enter “0.”)

!

7

00

!

8. Income Tax: From Tax Tables or Tax Calculation Schedule (See instructions, Page 14)

8

00

.

!

9. Divide Line 6 by Line 5 (If Line 6 is equal to or greater than Line 5, enter 1.0000)

9

!

10. Multiply Line 9 by Line 8

10

00

11. Credit for Income Taxes Paid to Qualifying Jurisdictions for Part-Year Residents Only

!

Tax

(From Schedule 2 , Line 58)

11

00

12. Subtract Line 11 from Line 10 (If Line 11 is greater than Line 10, enter “0.”)

12

!

00

13. Connecticut Alternative Minimum Tax (From Form CT-6251)

13

!

00

14. Add Line 12 and Line 13

!

14

00

15. Adjusted Net Connecticut Minimum Tax Credit (From Form CT-8801)

!

15

00

16. Connecticut Income Tax (Subtract Line 15 from Line 14. If less than zero, enter “0.”)

!

16

00

"

17. Individual Use Tax (Complete the Individual Use Tax Worksheet. See Instructions, Page 15. )

!

17

00

18. Total Tax (Add Line 16 and Line 17)

!

18

00

Payments

"

!

19. Connecticut tax withheld (From Schedule CT-1040WH, Line 3. See instructions, Page 15. )

19

00

Failure to

!

20. All 2003 estimated tax payments and any overpayments applied from a prior year

20

00

attach W-2s

!

21. Payments made with Form CT-1040 EXT (Request for extension of time to file)

will result in the

21

00

disallowance of

22. Total Payments (Add Lines 19, 20, and 21)

!

00

22

withholding.

!

23. If Line 22 is greater than Line 18, enter amount overpaid. (Subtract Line 18 from Line 22)

00

23

R e f u n d

!

00

24. Amount of Line 23 you want applied to your 2004 estimated tax

24

00

!

25. Amount of Line 23 you want to contribute to charity (From Schedule 3, Line 59) Total Contributions

25

26. Amount of Line 23 you want refunded to you. (Subtract Lines 24 and 25 from Line 23)

!

REFUND

26

00

For faster refund, choose direct deposit and complete Lines 26a, 26b, and 26c.

To Direct Deposit

Type of Account: !## Checking !

Savings

26a.

your refund, you must

26b. !

!

26c

complete Lines 26a,

.

26b, and 26c, at left.

Routing Number

Account Number

!

00

27. If Line 18 is greater than Line 22, enter the amount of tax you owe. (Subtract Line 22 from Line 18)

27

28. If late: Enter Penalty (Multiply Line 27 by 10% (.10))

!

00

28

Amount

You Owe

29. If late: Enter Interest (Multiply Line 27 by number of months late or fraction thereof, then by 1% (.01))

!

00

29

30. Interest on underpayment of estimated tax (From Form CT-2210. See instructions, Page 16. )

00

!

30

"

31. Amount you owe with this return (Add Lines 27 through 30)

00

! "

!

31

AMOUNT YOU OWE

Check if paying by credit card

(See instructions, Page 16)

SEE PAYMENT AND MAILING INSTRUCTIONS ON REVERSE

TAXPAYERS MUST SIGN DECLARATION ON REVERSE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2