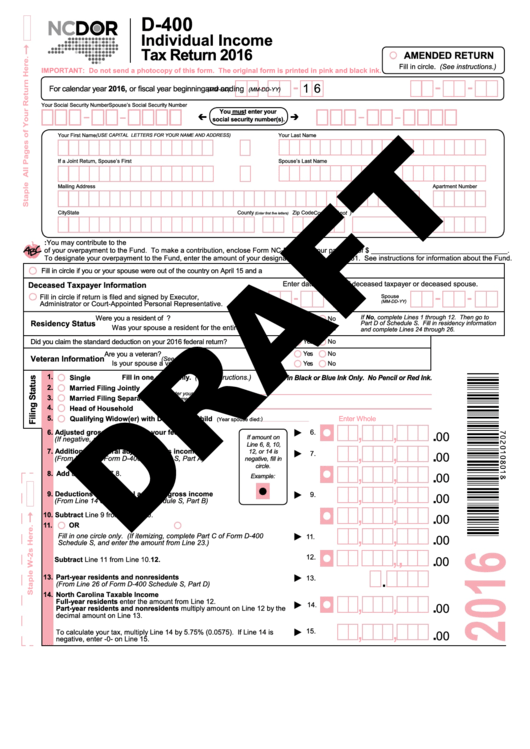

Form D-400 - Individual Income Tax Return - 2016

ADVERTISEMENT

D-400

Individual Income

Tax Return 2016

AMENDED RETURN

Fill in circle. (See instructions.)

IMPORTANT: Do not send a photocopy of this form. The original form is printed in pink and black ink.

1 6

For calendar year 2016, or fiscal year beginning

and ending

(MM-DD)

(MM-DD-YY)

Your Social Security Number

Spouse’s Social Security Number

You must enter your

social security number(s).

Your First Name

(USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

M.I.

Your Last Name

If a Joint Return, Spouse’s First Name

M.I.

Spouse’s Last Name

Mailing Address

Apartment Number

City

State

Zip Code

Country (If not U.S.)

County

(Enter first five letters)

N.C. Education Endowment Fund: You may contribute to the N.C. Education Endowment Fund by making a contribution or designating some or all

of your overpayment to the Fund. To make a contribution, enclose Form NC-EDU and your payment of $ ___________________________________.

To designate your overpayment to the Fund, enter the amount of your designation on Page 2, Line 31. See instructions for information about the Fund.

Fill in circle if you or your spouse were out of the country on April 15 and a U.S. citizen or resident.

Enter date of death of deceased taxpayer or deceased spouse.

Deceased Taxpayer Information

Fill in circle if return is filed and signed by Executor,

Taxpayer

Spouse

(MM-DD-YY)

(MM-DD-YY)

Administrator or Court-Appointed Personal Representative.

If No, complete Lines 1 through 12. Then go to

Were you a resident of N.C. for the entire year of 2016?

Yes

No

Residency Status

Part D of Schedule S. Fill in residency information

Was your spouse a resident for the entire year?

Yes

No

and complete Lines 24 through 26.

Did you claim the standard deduction on your 2016 federal return?

Yes

No

Are you a veteran?

Yes

No

Veteran Information

(See Instructions.)

Is your spouse a veteran?

Yes

No

1.

Fill in one circle only. (See instructions.)

Single

Print in Black or Blue Ink Only. No Pencil or Red Ink.

2.

Married Filing Jointly

Name

(Enter your spouse’s

3.

Married Filing Separately

full name and Social

Security Number.)

SSN

4.

Head of Household

5.

Qualifying Widow(er) with Dependent Child

Enter Whole U.S. Dollars Only

)

(Year spouse died:

,

,

.

6.

6. Adjusted gross income from your federal return

00

If amount on

(If negative, see instructions.)

Line 6, 8, 10,

,

,

.

7. Additions to federal adjusted gross income

12, or 14 is

7.

00

(From Line 6 of Form D-400 Schedule S, Part A)

negative, fill in

,

,

.

circle.

8. Add Lines 6 and 7.

8.

00

Example:

,

,

.

9. Deductions from federal adjusted gross income

9.

00

(From Line 14 of Form D-400 Schedule S, Part B)

,

,

.

10. Subtract Line 9 from Line 8.

10.

00

11.

N.C. standard deduction

OR

N.C. itemized deductions

,

,

.

Fill in one circle only. (If itemizing, complete Part C of Form D-400

11.

00

Schedule S, and enter the amount from Line 23.)

,

,

.

12.

00

12.

Subtract Line 11 from Line 10.

.

13.

Part-year residents and nonresidents

13.

(From Line 26 of Form D-400 Schedule S, Part D)

14.

North Carolina Taxable Income

,

,

.

Full-year residents enter the amount from Line 12.

14.

00

Part-year residents and nonresidents multiply amount on Line 12 by the

decimal amount on Line 13.

,

,

.

15. North Carolina Income Tax

15.

To calculate your tax, multiply Line 14 by 5.75% (0.0575). If Line 14 is

00

negative, enter -0- on Line 15.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2