Form D-400 - Individual Income Tax Return - 2014

ADVERTISEMENT

April 1, 2015

NORTH CAROLINA’S REFERENCE TO THE INTERNAL REVENUE CODE UPDATED -

IMPACT ON 2014 NORTH CAROLINA CORPORATE AND INDIVIDUAL INCOME TAX

RETURNS

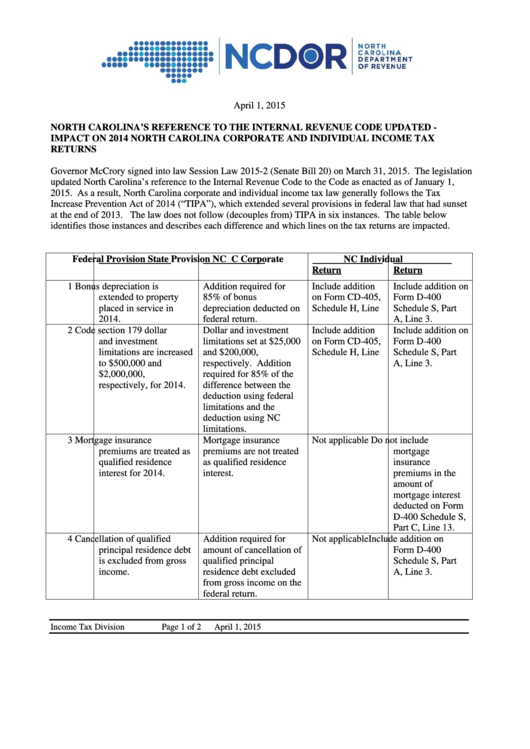

Governor McCrory signed into law Session Law 2015-2 (Senate Bill 20) on March 31, 2015. The legislation

updated North Carolina’s reference to the Internal Revenue Code to the Code as enacted as of January 1,

2015. As a result, North Carolina corporate and individual income tax law generally follows the Tax

Increase Prevention Act of 2014 (“TIPA”), which extended several provisions in federal law that had sunset

at the end of 2013. The law does not follow (decouples from) TIPA in six instances. The table below

identifies those instances and describes each difference and which lines on the tax returns are impacted.

Federal Provision

State Provision

NC C Corporate

NC Individual

Return

Return

1

Bonus depreciation is

Addition required for

Include addition

Include addition on

extended to property

85% of bonus

on Form CD-405,

Form D-400

placed in service in

depreciation deducted on

Schedule H, Line

Schedule S, Part

2014.

federal return.

1.g.

A, Line 3.

2

Code section 179 dollar

Dollar and investment

Include addition

Include addition on

and investment

limitations set at $25,000

on Form CD-405,

Form D-400

limitations are increased

and $200,000,

Schedule H, Line

Schedule S, Part

to $500,000 and

respectively. Addition

1.g.

A, Line 3.

$2,000,000,

required for 85% of the

respectively, for 2014.

difference between the

deduction using federal

limitations and the

deduction using NC

limitations.

3

Mortgage insurance

Mortgage insurance

Not applicable

Do not include

premiums are treated as

premiums are not treated

mortgage

qualified residence

as qualified residence

insurance

interest for 2014.

interest.

premiums in the

amount of

mortgage interest

deducted on Form

D-400 Schedule S,

Part C, Line 13.

4

Cancellation of qualified

Addition required for

Not applicable

Include addition on

principal residence debt

amount of cancellation of

Form D-400

is excluded from gross

qualified principal

Schedule S, Part

income.

residence debt excluded

A, Line 3.

from gross income on the

federal return.

Income Tax Division

Page 1 of 2

April 1, 2015

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4